Gone are the days when shopping malls were merely places to buy the latest CDs or trend-setting sneakers. Across the country, shopping centers are reinventing themselves as “the place to be” for teens, kids and their parents.

“Nowadays malls have almost become the new community center,” says Lynne Kadela, senior customer marketing manager, Coca-Cola North America.

Among the largest mall chain owners, the Simon Property Group, General Growth Properties, The Mills Corp. and Rouse Co. Properties held a multitude of events targeting teens, children and their parents throughout 2003, and several more are in development for 2004.

“With event marketing you get to talk to customers one-on-one and communicate with them in a way that is very different from other types of marketing,” says Howard Horowitz, president, NY-based Elite Marketing, an agency specializing in credit card event marketing. “Malls give companies the ability to produce volume with very little lead time and the ability to target specific products to specific regions of the country,” points out Simon senior VP-business development, Mikael Thygesen.

Simon is planning programs that will hit all target segments in 2004, ranging from women ages 25 to 50, to men, who make up 39% of Simon visitors. Additional programs currently in development include platforms aimed at teens, boomers, entertainment, holiday and fitness.

Mall rats

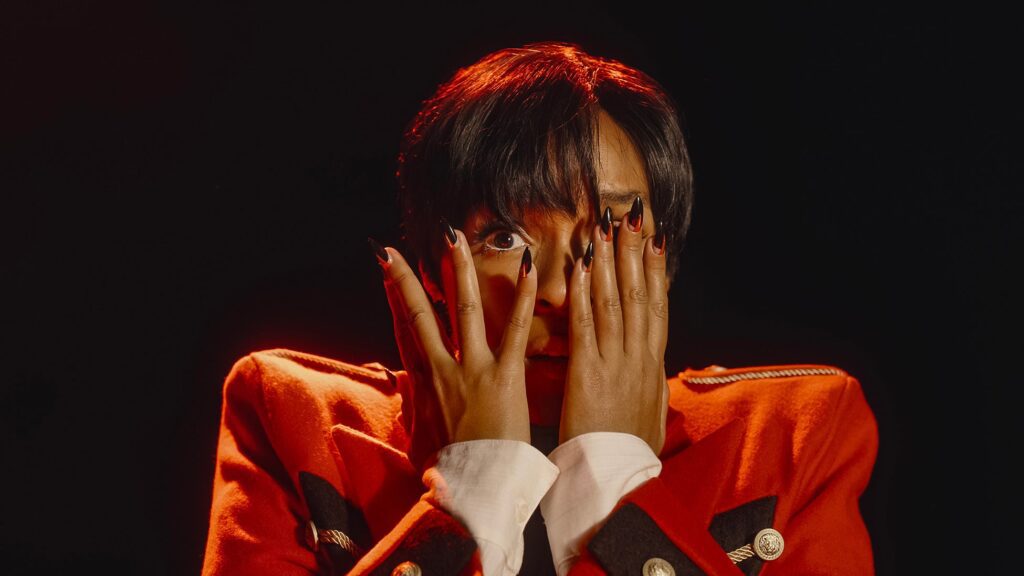

Topping Simon’s list: the Sprite-sponsored DTour Live will return in time for the back-to-school season.

The 2003 DTour was an 11-week, 13-market road show featured at 25 Simon locations across the country. Via the tour, major brands were able to reach over 19,000 teens. Attendees received “swag bags” filled with store coupons and sponsor samples from 24 youth-oriented retailers including Aeropostale, Wet Seal, Gadzooks, Finish Line, Rave, Pac Sun, Claire’s Boutique, Foot Locker and Steve Madden.

The tour showcased live performances from teen-friendly entertainers Lil’ Mo and 3LW, as well as interactive competitions, contests and challenges attracting between 1,500 to 4,000 kids per mall. Boston-based Alloy Marketing and Promotions (AMP) helped to develop the national tour. “We pride ourselves on coming up with creative events,” says Tom Schneider, CMO of AMP. “It’s all about getting people closer to the cash register by providing retailtainment, keeping people there longer by entertaining them.”

Malls have become synonymous with teenagers, as they are one of the few places that adolescents are encouraged to congregate. “Malls are such social centers for teens — they can touch and feel and experience your brand,” says Danielle Bertarelli, director of marketing and public affairs for Nickelodeon’s The N network. Simon research shows that teens visit Simon malls 325 million times a year and spend an average of $50 per visit.

A combination of factors goes into determining ROI for mall events, including positive consumer and customer feedback, added value to the consumer, media value and impressions, increased mall traffic and vending sales. “Malls are great venues for entertainment events, but they are also good for guerrilla marketing in regards to sampling, conducting market research or conducting a special promotion with coupons,” Kadela concludes.

Also targeting the teen audience, The Real Access Mall Tour kicked off in December hitting both General Growth Property and Simon malls. According to Bertarelli, “With the natural teen footfall, we are able to do an event and situate it outside of teen-targeted stores. Malls also offer a controlled environment where weather is not a deciding factor.”

The tour provided an interactive Hollywood experience promoting The N and its new series Real Access. “Event marketing does something really big to raise brand awareness,” comments Matt Britton, executive VP-sales and marketing for NY-based Mr. Youth, which handles marketing for the tour.

Brands can easily reach teens in a mall environment since “the teen market has a lot of boundaries. A marketer can’t set up a tour easily within the property of a high school,” explains Britton. “There is a need to find a venue where teens as a whole aggregate as a community — the easiest way to touch them is in a mall.”

Each day, between 1,000 and 5,000 visitors enjoyed celebrity look-a-likes, massages, hairstyling, make-up application and a trivia wheel. ROI measurement is important for The N in planning future mall events. “We measure ROI in different ways: by the number of premiums we give out and by looking at photos to see the numbers of kids and the demographic. We also train the local staff to ask kids questions and listen carefully to their responses,” says Bertarelli. “Feedback is very important; we want to know what was most popular and what worked.”

Family destinations

The Arlington, VA-based Mills Corp. has conducted onsite research with consumer focus groups in order to find out which programs add value to the shopping experience. “Nothing we do is cookie cutter,” says Petra Maruca, VP-partnership marketing.

Recently St. Louis Mills partnered up with PBS Kids to launch the first-ever PBS Kids Backyard. The 3,000 square-foot permanent playground opened in November, in a PBS-branded shopping district, dubbed the PBS Kids Neighborhood, which features child-friendly stores and restaurants.

“In creating the destination, the goal was to drive incremental traffic and convert it to sales for specific retailers in the area,” Maruca says.

The Backyard features full-sized play structures, is equipped with computer stations and includes a small theater for PBS character events. “It’s a great way to connect with the brand in a community center like The Mills,” says Judy Harris, executive VP-PBS business and development.

Over 200,000 parents and children attended the opening weekend ceremonies. Attendance was measured by vehicular and consumer traffic.

PBS and Mills plan to launch PBS Backyards in Cincinnati, Pittsburgh and two other unspecified locations.

The Lego Co. joined forces with The Mills for an interactive holiday event to benefit Habitat for Humanity International. All 26 Mills malls featured “Build an Ornament” centers, strategically positioned near Santa’s Village. For a suggested donation of $1, children created ornaments out of Lego elements to be tagged with their names and ages and hung on a tree throughout the holiday season. In addition, kids received Lego coupons while sitting on Santa’s lap to use at Lego kiosks featured at 15 Mills properties.

The companies partnered to produce an integrated national sweeps featuring a grand-prize vacation including airfare to Legoland Park in Carlsbad, CA. The campaign reached more than one million households online at mall Web sites, at Mills properties and through direct mail. “We agreed with Mills to help each other out. Lego helped by supplying the Legoland Park for a sweepstakes prize and Mills got an airline to participate. This way everybody wins,” says William Higgins, spokesperson for The Lego Co.

Looking ahead, Lego plans to bring its image to malls across the country in 2004. “Once you get people on board, the next year gets better and can spin off to other events,” concludes Higgins.

Also exhibiting kid’s toys for the holiday season, Nintendo kicked off the Who are You? Mall Tour in 12 markets around the country in October showcasing new games. “It’s up to us to make sure that our footprint is spectacular,” explains Robert Matthews, director of advertising and promotions for Nintendo. “We know that there’s a lot going on during the holidays so we try to engage consumers on a one-on-one level and allow them to interact with our product and character franchises.” Interactive gaming stations were set up at Lakeside Mall in Minneapolis, and Perimeter Mall in Atlanta, both Simon and Rouse Co. properties.

“We want an ongoing relationship with consumers, an interactive experience,” explains Brad Bryen, president of New York-based US Concepts, which handles marketing for the tour. Nintendo products were not sold on site, although, the event featured giveaways and premium items.

More than 4,000 people per day passed through the malls during the tour, which lasted through December. “We weren’t relying on just ambient traffic, we were definitely driving traffic to the mall,” says Bryen. “Malls are great environments for reaching a particular target; when used correctly they can be a great partner.”

Network

Network