Loyalty programs of all kinds are under pressure to distinguish themselves from the pack, now that the average U.S. household belongs to 14 programs but is active engaged with only six. Providers are all looking for an advantage that can help them break through the clutter. And that’s as true of the rewards-based financial card programs as it is for the airline and lodging industries.

Loyalty programs of all kinds are under pressure to distinguish themselves from the pack, now that the average U.S. household belongs to 14 programs but is active engaged with only six. Providers are all looking for an advantage that can help them break through the clutter. And that’s as true of the rewards-based financial card programs as it is for the airline and lodging industries.

Citi has been actively innovating in its credit card rewards programs to try to make sure that its financial cards are the relevant ones that consumers reach for when they make a purchase. The issuer has taken a multi-track approach, rolling out new ways to customize rewards that can be acquired with points but also testing some distinctly different ways to actually redeem those points.

Terry O’Neil, executive vice president of North American marketing for Citicards and manager of Citi’s affluent consumer segment, outlined some of these changes and tests in a presentation at the Promotion Marketing Association’s Integrated Marketing conference in April and in a subsequent interview.

The credit-card space has become very competitive in the aftermath of the recession, O’Neil said, with consumers at all income levels carrying fewer cards. O’Neil pointed to research that suggested that 85% of affluent customers expressed interest in deals or rebates, and 74% said they had begun asking themselves if specific purchases were necessary.

“Customers have changed from the free-spending ways of 2008,” he said. “So it’s incumbent upon us to build deeper relationships with our customers to maintain their loyalty.”

Rewards are one important way to do that, he said, and financial rewards programs have seen strong expansion in recent years, growing 77% from 2007 to 2009. But affluent users tell Citi they are choosing to put the overwhelming majority of their spending on the card that provides the best perceived reward value, ignoring other cards they may also own.

“Our customers have told us that rewards are a key determining factor when they’re choosing a new credit card or when they’re swapping out the primary card in their wallet,” O’Neil said. The rise of new payment technologies, from PayPal and Google Checkout to mobile wallets, is also creating ferment among traditional payment providers such as Citi and tightening the competition for consumers buying attention.

One of the rewards innovations Citi rolled out in January of this year was a streamlined version of its ThankYou rewards program consolidated behind two specific card products, Citi ThankYou Preferred cards and Citi ThankYou Premier. Pre-2010, Citi was operating some 10 different types of rewards cards, offering everything from the bank’s proprietary ThankYou rewards to rebates on a mortgage or cash back towards an auto purchase.

“Customers want simple, transparent value propositions, and having 10 different products out there made it very difficult for them to determine where the best value was,” says O’Neil.

The new program removes expiration dates on rewards and removes earnings caps to the points that can be earned. It relies on the proprietary ThankYou currency for rewards and provides a clear upgrade strategy for customers who want to earn more rewards with their purchases. The basic card serves as an entry point for young adult users that Citi hopes to attract and gives them points not only for purchases using the card but for behaviors Citi wants to encourage, such as enrolling in online banking and paperless statements.

The higher card level caries an annual fee but ups the ante on rewards, with higher rewards earning levels, a bonus for each year of membership, travel benefits, and access to a Citi “wish specialist”, an attendant who can help users customize the rewards on which they can spend their points.

"The 'Your Wish Fulfilled’ program means that you can call us or email us and tell us what you want, so that you’re not tethered to the [rewards] catalog,” O’Neil said. “The Wish Specialist will price that product out in ThankYou Points, get it for you and deliver it.”

The “Wish Fulfilled” program actually had been in place at Citi for five years or so before the current rewards refresh, but the company had never brought it forward as a point of promotion for its rewards. O’Neil said the idea to make it a centerpiece of both the ThankYou platform and Citi’s current mass-media advertising came when his team looked through the list of things grass-roots users had asked Citi to apply their points to: a custom-made saddle, home remodeling work for a nursery, special tires for a rebuilt classic MG, or—as in the current TV spot—a slot at a rock ‘n’ roll fantasy camp.

“When you can deliver that reward to them that they had not expected, what that adds to the relationship with the customer is really invaluable,” he said.

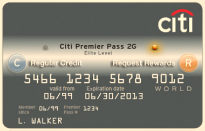

Another innovation Citi launched to make its rewards cards more useful to target customers is the Citi 2G Card, a product that will let users decide right at the register whether they want to pay for a purchase with standard credit or with their accrued ThankYou rewards points.

The card looks and feels like a standard credit card, but it actually contains a small microprocessor, a battery and two buttons marked “C” for credit and “R” for rewards. Pressing “R” sends a signal to Citi that the customer wants to use rewards to pay for a purchase in any retail location where they might normally use a credit card. The button pressed lights up to confirm the user’s payment selection.

Citi’s O’Neil is featured in this short video explaining the basics of the new 2G card:

Redemption through the 2G card would contrast with Citi’s current redemption system, under which user go to the Citi ThankYou Web site, select a reward from the online catalog—either a product from selected merchant providers or a Citi gift card– and wait for it to arrive in the mail.

“Customers never asked us for a fancy credit card with lights and buttons on it,” O’Neil said. “What they did say they wanted was more flexibility in how they redeem their points, and to be able to use their points for anything they want, from a flat-screen TV to a cup of coffee.

“We went back and asked what that ultimate level of flexibility is. And in our line, it’s letting customers redeem their points for whatever they want in their daily lives.”

The 2G card puts a purchase through as a credit transaction first, but if the customer has pressed the rewards button and has sufficient points in his account, those points will be applied to the purchase at the end of the day and will show up as a redemption on the rewards statement and a confirmation of their points use via text message or email.

That credit-first process is designed in part to avoid the chance that a customer would try to pay with points but come up short and be embarrassed at the point of sale, O’Neil said. It also allows Citi to roll the card out without asking merchants to change their POS terminals.

The prototype Citi 2G card was tested first in-house last year by employees, and that pilot has now extended to selected invited Citi ThankYou customers. An online 2G community forum confirms that customers using the new more flexible rewards card do feel more engaged with Citi’s loyalty program as a result. The Citi 2G card is expected to be offered to new ThankYou program registrants later this year, and also to be offered to more existing program members.

Press reports say the Citi ThankYou points are valued at a penny, so that a user who racks up 2,500 points will be able to apply them to a $25 dollar purchase.

One early learning Citi has acquired from 2G card use so far: the need to add a “lock” feature once the customer had opted for a payment type. “Users found that when they handed the card over in a restaurant, servers were fascinated by the buttons and lights and kept pressing the buttons,” O’Neil said. “On the other hand, they also loved the fact that merchants and people in line behind them at the register thought the card was cool and asked them how they got it.”