The continuing growth in spend on AI-powered campaigns such as Google’s Performance Max (PMax) and Meta’s Advantage+ is among the notable findings in the Q4 2024 Digital Ads Benchmark Report from performance marketing agency Tinuiti. The report is based on anonymized data from ad programs under Tinuiti’s management.

In both the third and fourth quarters of 2024, Advantage+ accounted for 34% of the Meta ad budget of Tinuiti’s retail/ecommerce clients, up from 27% in the fourth quarter of 2023. Among advertisers running both PMax and standard Google Shopping campaigns, PMax accounted for 69% of their ad dollars; in fact, more than 95% of Google Shopping advertisers also ran PMax campaigns.

“A lot of spend is going on there,” says Mark Ballard, Tinuiti’s director of research. And it’s not just advertisers doing the spending; platforms are spending on AI, too, in hopes of wooing more brand dollars. Pinterest, for instance, launched Performance+, its equivalent to Advantage+, in October 2024. “It’s something to be aware of: where the platforms are investing.”

Ad growth wasn’t limited to AI-powered campaigns. Having introduced Prime Video ad inventory in the first quarter of 2024, Amazon had nowhere to go but up in terms of adoption. But Ballard is nonetheless surprised by the speed of its ad growth: Spend had grown 726% between Q1 and Q4. “And we’re still seeing a lot of adoption,” he says. “More brands are coming into the platform.” Prime Video helped boost overall fourth-quarter streaming video ad spending—discounting YouTube—19% year over year.

Also seeing tremendous growth in the past couple of years was Walmart Sponsored Products, according to Ballard. Tinuiti clients spent 53% more on the platform in Q4 2024 than they had a year prior. A 51% rise in CPC drove most of that growth.

Other notable findings include:

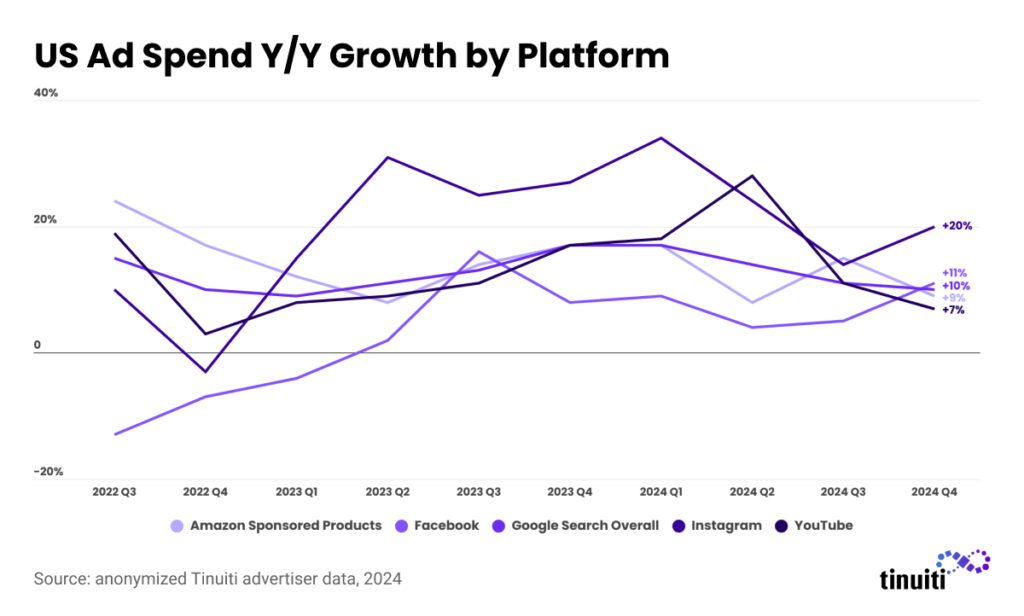

- YouTube: Fourth-quarter ad spending on standard YouTube video campaigns rose a modest 7% year over year, as CPM fell 16% during the same period. Spending on YouTube CTV campaigns, however, soared 60%, accounting for 39% of spend on the platform. While phones still accounted for the largest share of YouTube ad dollars—44%—that was down from 53% for Q4 2023.

- TikTok: Uncertainty about the future of TikTok didn’t dampen advertising spending on the platform; fourth-quarter spend rose 13% year over year. While that might not seem to be especially impressive growth, Ballard notes that it was up against a tough year-ago comp, as year-over-year ad spend for Q4 2023 had been up 64%. “We haven’t seen advertisers pull out of TikTok,” Ballard says. “I think as long as it’s operating legally, they’re going to be there.”

- Facebook grew its ad dollars from Tinuiti clients 11% from the previous fourth quarter, its largest year-over-year growth since Q3 2023. The platform continued to account for the majority of ad spend on Meta, 64%. Though Instagram brought in only 35% of Meta’s ad money, it enjoyed a 20% jump in year-over-year ad dollars for the fourth quarter. Much of that increase was due to the continued growth of Reels inventory.

- Snapchat and Pinterest: Among the smaller platforms, fourth-quarter ad spend on Snapchat increased 20% year over year. Pinterest saw more-modest growth of ad dollars at just 8%. Pinterest did turn around its trend in declining CPM, however; CPM increased 21% year over year, compared with YOY drops of 17% for Q3 and 11% in Q2.

As for what 2025 might bring, Ballard is circumspect. “We’ll probably see growth slowing ahead in the first half and coming back in the second half,” he says. “Obviously what happens in the macro economy will be very important. That’s the big question right now.”