Search engine advertising isn’t immune from the fragmentation affecting connected television and other forms of advertising, according to adMarketplace’s “State of Search in 2025.” The first of what will be a series of annual reports shows, among other things, that Google and its search engine results pages are no longer monopolizing how consumers search and shop.

“People tend to assume that people are set in their ways, especially in the way they want to shop and approach the research they do before they make a purchase. But the biggest finding is that people are changing,” says Asher Feldman, VP of Analytics at the search advertising marketplace. In fact, 55% of the 1,000 U.S. consumers surveyed said they now search for product and brand information differently than they did five years ago.

Just 33% of those surveyed said they discover new products via search engines, while 44% do so from online ads. “If only a third are discovering new products through search engine alone, that leaves a lot of space for other ways to reach them,” Feldman says. Beyond the initial discovery phase, 42% of respondents said they always or often search for more product information after seeing an ad, and 74% purchased a product they saw advertised online.

Social, BNPL and Review Sites as Search Options

As you’d expect, the most popular channels of product discovery vary by generation. Social media tops the list for Generation Z and millennials, with 77% of the former and 70% of the latter having discovered new products via the channel. For older consumers, brick-and-mortar stores were the most popular discovery channels, cited by 53% of Gen Xers and 60% of baby boomers and older consumers. In second place among Zoomers were ecommerce sites, with 51% listing them as a means of discovering products. For both millennials (51%) and Generation X (53%), brick-and-mortar stores were the second most popular, and for older consumers it was word of mouth (56%).

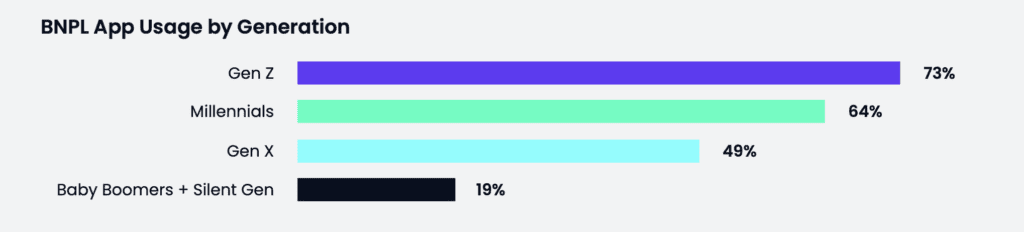

It’s also not surprising that younger consumers are the ones more likely to turn to nontraditional channels for product discovery. Buy now, pay later (BNPL) apps are a case in point. While 51% of Americans have used them, they’re most popular with Gen Z (73%) and least popular with boomers and older consumers (19%). Among consumers who have used BNPL apps, 60% discovered new products or brands through them.

Likewise, members of Gen Z are almost twice as likely to use editorial and review sites than are baby boomers and older consumers: 55% vs 29%. All told, 45% of the consumers surveyed used these sites to discover new brands or products—and of those, 74% made a purchase via a product ad or link afterward.

What’s more, 62% of Gen Z and 60% of millennials use alternative browsers such as Firefox and DuckDuckGo often or always, compared with 48% of consumers overall. Of those users, 78% credit the browsers with helping them find new products or brands.

Catching Up to Consumers

While consumers are turning to more search alternatives, “marketers as a whole tend to be slow movers. Consumers are always going to lead the way. There’s always going to be a lag,” Feldman says. “And the survey data says there are still things consumers are looking for.” For example, 38% want real-time information in their search results, and 34% seek more relevant product recommendations.

In the meantime, Feldman advises marketers to catch up with consumers by testing ads on review sites, BNPL apps and alternative browsers. “The real strategic imperative is not to say ‘Okay, all my budget [that] I have open questions about should go to BNPLs’ but rather to consider different places than you might expect.”

A lack of transparency and consistency regarding performance metrics does make exploring new channels a challenge for marketers. “You have to consider the quality of the incremental spend,” Feldman says. “You need to be able to compare those metrics of cost across marketing channels. You need to collect data about these new channels to make the comparison.”

Nonetheless, particularly for marketers striving to reach younger shoppers, testing these alternative discovery channels before the competition catches up is worth it. “Search engines are still an effective way to shop, but not the only way to shop,” Feldman says, “and consumers are hungry for a new way to shop.”