A new report that examines the mobile capabilities of 100 top brands in luxury categories from fashion and hospitality to beauty/skincare and jewelry hands out some seriously poor grades to a large number of famous names.

The study, the L2 Prestige 100 Mobile IQ ranking, examined the mobile apps, sites, marketing and mobile innovation of 100 high-end U.S. brands and, on the basis of their performance across some 250 data points, graded their mobile performance as Genius, Gifted, Average, Challenged or Feeble. And according to the report, from NYU Stern School of Business professor Scott Galloway and experts from digital firm L2, nearly half those brands’ mobile efforts were judged as Feeble.

Of the brands studied in the report, 30% have not designed a mobile app, and 33% do not currently optimize their web site for mobile viewing. While some 52% of the brands operate both a smartphone app and a mobile site, 16% have yet to launch any mobile strategy at all and instead simply serve up their standard web site to mobile browsers.

Of the brands studied in the report, 30% have not designed a mobile app, and 33% do not currently optimize their web site for mobile viewing. While some 52% of the brands operate both a smartphone app and a mobile site, 16% have yet to launch any mobile strategy at all and instead simply serve up their standard web site to mobile browsers.

Further, although mcommerce sales in the U.S. are projected by Forrester to increase from $6 billion in 2011 to $31 billion by 2016, only 31% of the mobile apps studied for the Mobile IQ project could accept transactions, and only 67% of the mobile sites studied could do so.

As a result, the study concluded that 44% of the 100 brands studied offered users only a “Feeble” mobile experience. A further 24% were mobile “Challenged”, and 18% of those brands were judged “Average” in their mobile presence. Only 10% of the names qualified for a “Gifted” ranking, and only 4% of the hundred were found “Gifted” in their mobile integration.

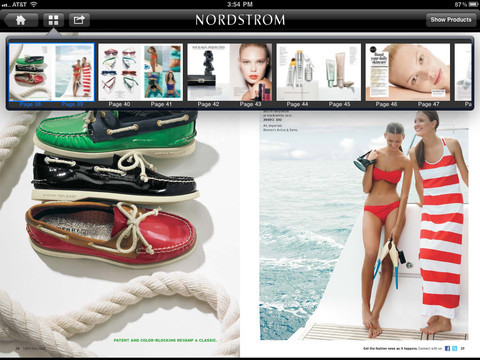

Those “Gifted” brands, as judged by L2, were Sephora, Nordstrom, Macy’s and online fashion retailer Net-a-Porter. Rounding out the top 10 were six names deemed “Gifted” for their mobile initiatives: Bloomingdale’s, L’Occitane en Provence, Tiffany & Co., Neiman Marcus, Intercontinental Hotels & Resorts, and Estee Lauder.

The difference in indexed points between the ranking leader Sephora(with 164 points) and the 100th ranked brand—watch and jewelry retailer Patek Philippe (8 points)—suggests that brands aren’t doing mobile badly so much as failing to do mobile at all. “With a median score of only 76, the majority of brands are just beginning to make mobile investments, while a select few early investors are pulling away from the pack,” the report concludes.

The L2 Prestige 100 Mobile IQ study looked at brands in five vertical industries: beauty/skincare, retail, fashion, jewelry and hospitality. While each vertical was represented in the top 20, retail outpaced the rest; of the 14 brands rated “Genius” or “Gifted”, half were retailers.

While evidence suggests that users who own both a smartphone and a tablet prefer to shop over the tablet, the brands studied for this report have not done much to accommodate those preferences. While two-thirds of the brands studied for this report have a mobile site, only seven have taken the trouble to develop an iPad-specific experience. Some 82% of brands sned iPad users by default to their main PC sites—and 18% of those weaken the experience by relying on Flash animation and other protocols that the iPad operating system does not support.

As for mobile apps among the Prestige 100, while 51% of those who have them integrate video content, far fewer branded apps include other tools for engaging users. Only 31% integrate smartphone GPS mapping; 17% include push notifications, and only 16% make use of the phone camera.

“Mobile competence may be a crystal ball for a brand’s global prospects,” Galloway said in a release accompanying the study. “Ground zero for growth in prestige exists among consumers who are increasingly turning to a small screen to learn about and ultimate consummate purchases of prestige brands. We appear to be entering the beginning of a persistent mobile era. Brands ignore this shift at their own peril.”

Other findings from the L2 Prestige 100 Mobile IQ study:

- Although 78% of the brands in the report engage in email marketing, only 24% offer mobile-optimized versions of their email messages.

- While 14% of global monthly Google searches for the brands in question originate from mobile devices, only 13% of those brands manage to make their mobile presences known on the first page of Google search results.

- Mobile cross-promotion is also weak among these top brands. Only 28% of brands with mobile apps do anything to promote them on their web sites, compared to 82% who link clearly to a Facebook page and 66% who promote their Twitter feed.

Network

Network