| Hispanics | General population | Emerging |

|---|---|---|

| Cash back | 54.7% | 45.4% |

| Points for free travel | 39.1 | 35.3 |

| Points for in-store redemption | 32.6 | 36.7 |

| Certificates | 28.2 | 40.1 |

| Points for Web/catalog redemption | 25.2 | 30.0 |

| Average hard benefit | 36.0 | 37.5 |

| Discounts | 47.9 | 41.5 |

| Upgrades | 20.8 | 17.4 |

| Members-only information | 19.7 | 23.2 |

| Members-only access | 13.7 | 17.9 |

| Average soft benefit | 25.5 | 25.0 |

| Source: Colloquy’s ‘A Comparison of Loyalty Marketing Perceptions Among Specific U.S. Consumer Segments’ | ||

OK, we know it’s a stereotype: Hispanics are loyal to their families.

But not all are loyal to brands — at least not judging from their involvement in loyalty programs.

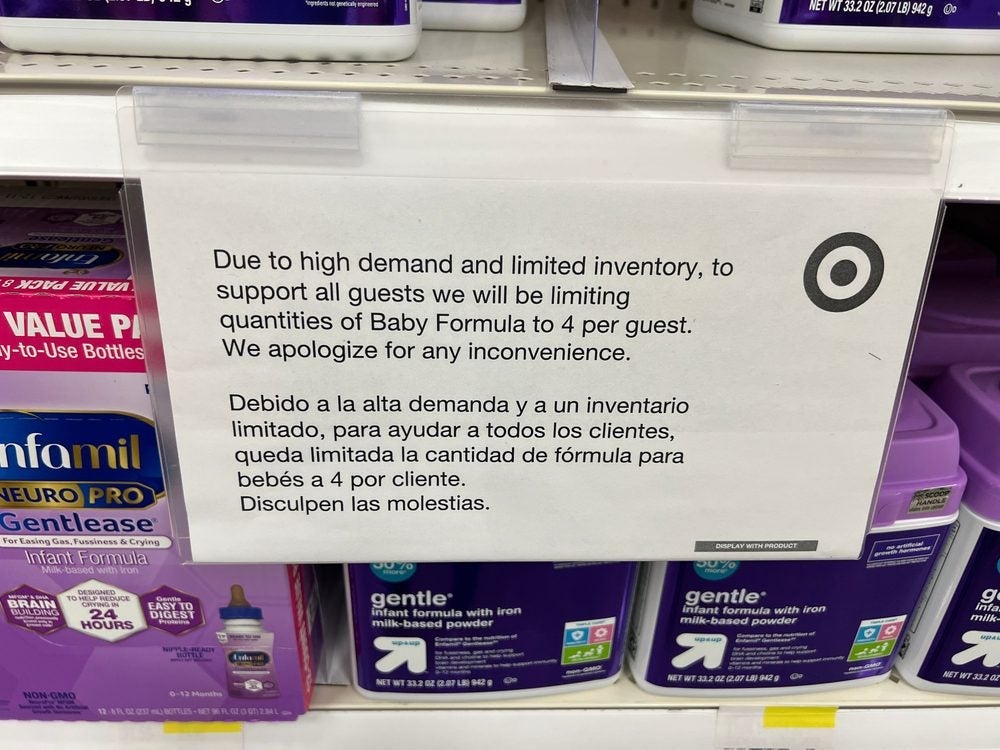

Around 40% of those classified as “emerging Hispanics” (those over age 21 with annual household incomes below $40,000) sign up for them, compared with 60% of the general population, according to a new study from loyalty marketing firm Colloquy.

Why the resistance?

Like other people, emerging Hispanics don’t want to pay fees, Colloquy says. And in some cases, they don’t find the rewards compelling.

Moreover, these folks are nearly three times as likely as other Americans to have privacy concerns.

So how do you draw these underserved consumers into a loyalty program? That’s a tough question.

Members of this group say they want soft benefits — that is, special privileges and members-only rewards.

But the programs they sign up for are more likely to provide hard rewards. These include certificates or points that can be redeemed for free travel, goods and services.

In fact, emerging Hispanics lead the U.S. population in redeeming program currency for electronics, magazine subscriptions and entertainment-related rewards.

Here’s another contradiction between desire and behavior.

Members of this segment lag in taking advantage of travel programs, a trait Colloquy chalks up to “spending deficiencies” — they don’t have as much money to spend, and don’t earn benefits as quickly.

But those who sign up for financial services programs are more likely to want airline travel. And they expect car-rental perks when they enroll in travel-related loyalty plans. Yet they’re less likely to seek free or discounted hotel rooms.

The good news? When emerging Hispanics do participate in a loyalty program, they tend to be very engaged. They read program statements and special offers.

That includes direct mail and e-mail, although people in this group are 25% more likely than others to dislike “junk mail,” as Colloquy put it.

And they respond better to surveys on their preferences — provided they’re actively involved in the program.

Finally, emerging Hispanics are more willing to recommend a financial services or travel program because of its benefits. (But they’ll tell friends about them at the same rate as everyone else.)

That’s important. Loyalty guru Frederick Reichheld has written that a consumer’s willingness to spread the word is the only metric that matters.

There’s one problem, though: This segment is very likely to be disappointed if a rewards scheme is stopped — much more so than the general population (travel programs excepted).

Colloquy cautions that the dynamics of the emerging Hispanic market will change as the group becomes more affluent.

W

For more CRM and database marketing material, go to http://directmag.com/disciplines/crm/.

Network

Network