PROCTER & GAMBLE WANTED to improve its retail marketing to Hispanics. It ended up bringing women to tears.

P&G started with a cause — breast cancer — and addressed one factor: Hispanic women are more likely to die from breast cancer because they’re reluctant to get mammograms or discuss screening.

So P&G brought screening to the supermarket, parking mobile mammography vehicles in grocery store parking lots in Texas and inviting shoppers in for free x-rays.

“Women would walk up gingerly and be invited in for a free mammogram, and they’d cry. Many have never had a mammogram; they didn’t have insurance,” says Frenchie Guajardo, strategist at agency PowerPact, which handled the three-year campaign for P&G.

Tie-ins with local hospitals assured that women with suspicious films got follow-up care.

P&G signed Colombian-American singer (and breast cancer survivor) Soraya as spokesperson; purchase of participating P&G brands earned shoppers a CD of Soraya songs and breast health information. The program expanded to Florida, Los Angeles, New York and Puerto Rico, and exceeded P&G’s payout goals by 20%.

“It helped the community and made retailers better community citizens,” Guajardo says.

Marketers spend $1 billion on cause marketing, on top of the $12 billion that corporate philanthropy programs donate to non-profits. Increasingly, that money is reaching consumers in their neighborhoods — even the supermarket parking lot. The Home Depot helps KaBOOM build playgrounds, and Habitat for Humanity build houses. The History Channel supports local historic preservation, including a $19.5 million deal signed in December to spiff up New York City landmarks.

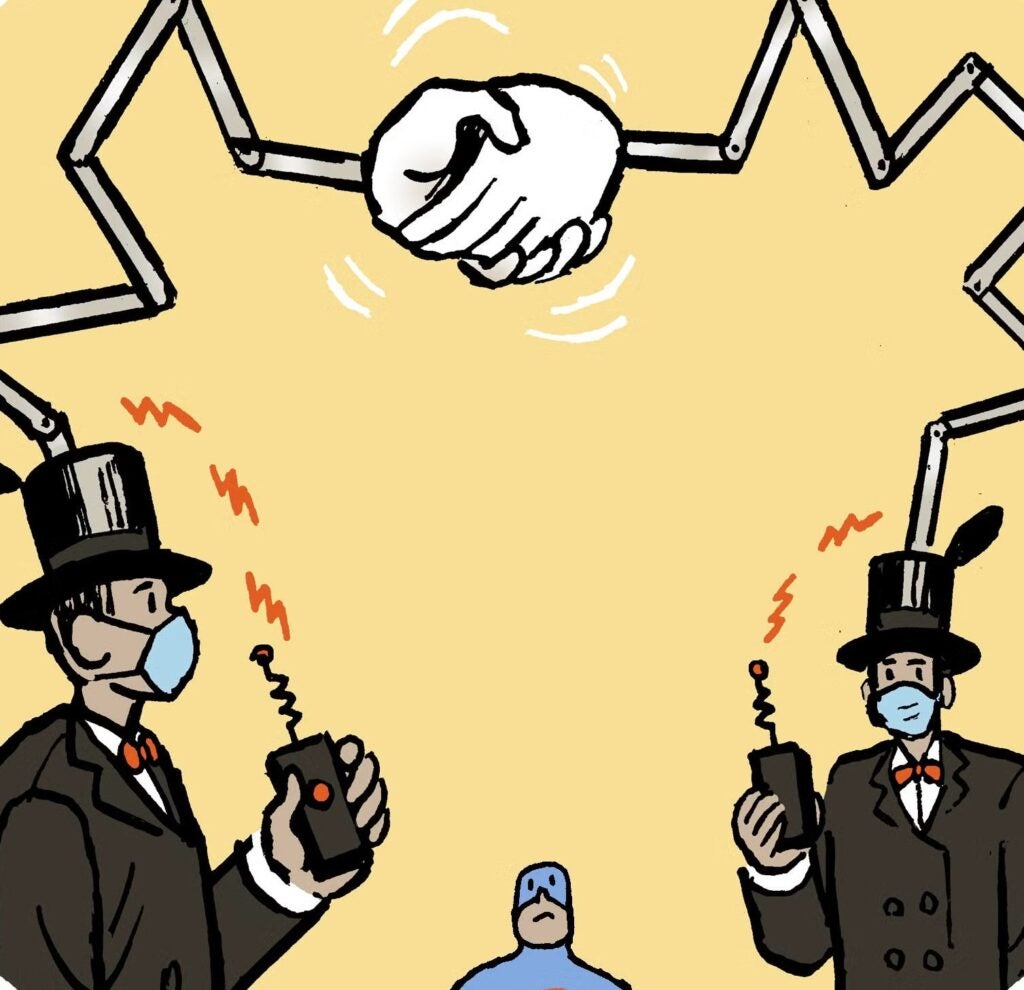

But local execution of a national program takes a lot of arms and legs, from the marketing staff at headquarters to employee and non-profit volunteers in each market. The trick is coordinating everyone; the benefit is a sincerity that can’t be planned.

Marketers are increasingly partnering with non-profits that have national recognition but do all their work via local chapters (think America’s Second Harvest, Habitat for Humanity, Susan G. Komen Breast Cancer Foundation). Most corporate donations are channeled back to local branches. To get the full benefit of that local halo, brands need to activate their tie-ins in each market. Marketers have three assets to do that: retailers, volunteers (including their own employees), and consumers themselves.

Retailers rise to the occasion

Retailers are especially keen to drive local efforts. Fully 73% of retailers prefer local or regional non-profits, while 64% of manufacturers prefer a national non-profit, according to a survey that PowerPact conducted with 200 retailers and manufacturers last year.

“One hundred percent of retailers demand that [manufacturers’] cause programs have local benefits, because retailers are focused on connecting with customers where they live,” says PowerPact strategist Melissa Radin. But retailers don’t want just any local charity: “It has to resonate with their customers,” she says. Retailers like a national cause that shoppers recognize, with benefits that shoppers feel locally.

That often means account-specific overlays for national tie-ins. General Mills’ Yoplait, a longtime Komen sponsor, runs a Salute to Survivors print campaign for Kroger Co., profiling Kroger employees who have survived breast cancer. “Consumers can see that it’s about someone in the community where they live,” says Risa Sherman, strategist at PowerPact, which handles Yoplait’s Komen sponsorship. A separate overlay for Safeway triggers donations to the local Komen chapter with each purchase of Yoplait, in addition to General Mills’ national donation to Komen through its long-running Save Lids to Save Lives campaign ($13 million so far, up to $2.1 million for 2004).

In fact, General Mills has backed away from activities at Komen’s Race for the Cure events in favor of account-specific overlays. The Golden Valley, MN-based company runs account-specific promotions in 20 markets, partnering with retailers to trigger additional donations for local Komen chapters. (Its national donation is split between all Komen chapters.) General Mills used to host Destination Yoplait tents at Race for the Cure sites, offering samples, massages, arts and crafts and kids’ activities. But “it was such a carnival atmosphere that it was hard to get recognition,” says David Fisher, Yoplait’s director of promotion marketing. “People weren’t associating it with Yoplait.” So General Mills shifted to measurable retail promotions. Most overlays are triggered by race schedules, some by retailers’ own promotion calendar.

Local overlays impress retail employees, too. “Staff turnover is a big deal for retailers,” says Sherman. “If employees see that the retailer is deeply committed to the community, that increases their loyalty, too.”

Putting volunteers to work

Some cause marketing campaigns leverage the non-profit partner’s volunteers. “Non-profits can make your offering far more compelling because they give a local face and emotional appeal,” says David Hessekiel, president of the Cause Marketing Forum, Rye, NY. “But they’re no replacement for the kind of field marketing you need to make local marketing work.”

A brand with its own stores (or franchisees) has staff in each market to work with local non-profit chapters. But many brands don’t have their own real estate — and “most CPGs don’t have a field force that strong,” Hessekiel notes. For them, “it’s especially important to look for a non-profit with representation in the markets the brand wants. Part of the due diligence is to understand how the non-profit is structured.”

Some non-profits send directives from headquarters to chapters; others let chapters operate independently. That affects how (and how well) sponsors’ promotions are executed. Joint training helps volunteers and non-profit staff work with marketing pros. Scholarship America and shoemaker Easy Spirit hold meetings for local reps (some volunteer, mostly staff) to map out each local event to show which person does each task.

But “be realistic about what a local chapter of a non-profit can do,” Hessekiel advises. “It’s unrealistic to expect a volunteer group is going to become your field force, just as you wouldn’t expect any other type of national promotion with local legs to happen magically.”

The American Heart Association taps its 2,200 chapters with 22 million volunteers to help execute its national Go Red for Women campaign, which kicks off its second year this month. The yearlong effort uses red dresses to publicize heart disease among women (it’s the leading cause of women’s deaths). The campaign, via Boston-based Cone Communications, kicks off Feb. 4 with Wear Red Day — companies let employees who donate $5 wear red clothes and jeans to work — and, like last year, offers dress-shaped lapel pins, brochures and wallet cards with tips on heart health. This year AHA adds Red Dress Statues, a collection of five-foot acrylic statues of dresses that are each sponsored by a celebrity and on display around the country. Local chapters host fundraisers and events; national sponsor Macy’s (2004-06) blends national and regional promos.

Last fall Ronnie Taffet, Macy’s point person for Go Red, spent two weeks with her AHA counterpart touring Macy’s divisions to brief marketing and p.r. staffs on national plans — and to hear their local plans, such as fashion shows and healthy-cooking demos.

“Last year everybody got very wrapped up in asking ‘What will national [marketing staff] do for me?’ and we got very clear very quickly that it wasn’t about national [marketing]. The emphasis now is on divisions doing things locally to capitalize on what’s being done nationally,” says Taffet, VP-public relations for Federated Corp. marketing. A master calendar of all promos went to all divisions in mid-January.

Nationally, a Valentine’s Day push sells a Go Red plush teddy bear (which can record a Valentine greeting) exclusively in Macy’s; a Mother’s Day tie-in with Hanes puts a Mira Sorvino-designed T-shirt exclusively on Macy’s shelves. A percentage of sales for each goes to AHA.

This is Macy’s first-ever sponsorship of a national non-profit. “Our employees and customers are 75% women; this [tie-in] is a no-brainer for us,” Taffet says. “It’s an opportunity for us to start something and really own it.”

Macy’s regional divisions set their own cause marketing; the AHA tie-in needs that local touch, too. “It’s really clear that we need to talk to customers on local level. That’s what they care about: how it’s affecting their community,” Taffet says.

Go Red for Women “burst upon public consciousness in a very powerful way,” Hessekiel says. The Cause Marketing Forum presents its non-profit 2005 Golden Halo Award to the AHA in June, largely due to its 2004 Go Red for Women effort. (Target Stores earns the corporate 2005 Golden Halo for its Take Charge of Education program.)

Employee volunteerism benefits programs, too. More and more cause-marketing contracts include volunteer time from employees, says Cone President Carol Cone. “Best practices combine money, in-kind resources and volunteerism time. We’re seeing a lot more of this because companies are trying to find ways to engage employees to show that [the company] has a soul.”

PNC Financial Services includes 100 million hours of volunteer time in its 10-month-old Grow Up Great school-readiness program. The effort — budgeted at $100 million over 10 years — ties in with Head Start (for local grants), Sesame Workshop (which created a parenting kit that’s distributed in local PNC branches) and local boards of education. PNC staffers volunteer locally; Cone handles.

Volunteering also develops employees’ leadership skills and builds cross-functional teamwork. “When people get out of their work garb and labor shoulder to shoulder with the VP, they see each other in a different light,” Cone says. “That builds morale and connectivity to the brand.” That’s especially important for Gen Y workers, who look for social commitment from their employers, Cone adds.

Consumers make the call

Consumers also like programs that let them choose the cause — think Campbell’s Labels for Education (30 years old) and Target’s Take Charge of Education (eight years old in April). “It’s part of a mass-customization trend that give consumers choices about how to participate,” says Cone.

Target’s program lets a shopper designate a local school to get a donation of 1% of purchases made with the shopper’s Target card. P-O-P, ads, e-mail and credit card statements that show how much the cardholder has donated all reinforce the message. Eight million cardholders support 110,000 schools through Take Charge.

“Target has tapped technology to localize a national issue and bring it down to the very core level,” Hessekiel says. “If Take Charge had been a more general push to support education, it wouldn’t have taken off as it has. People are very conscious of what’s going on in local schools.”

Take Charge is good business, too: Target signs up more cardholders than it would without the program. “It’s that wonderful road between a non-profit and for-profit company making a big difference in each others’ lives,” Radin says.

Marketers can link up with local non-profits through national networks that coordinate independent local groups. These networks bring national scale to neighborhood marketing — and let local groups pool their resources to woo national brands. America’s Second Harvest coordinates food banks as well as 1,300 Kids Cafés run by food banks and church or community groups; ConAgra has been Kids Cafes’ national sponsor since 1999. Children’s Miracle Network, an alliance of 170 children’s hospitals, has 28 U.S. corporate sponsors including Wal-Mart, Kroger Co., Delta Airlines and Coca-Cola. Its $2.2 billion in donations (over 10 years) funds equipment, research and charity care at member hospitals. Keep America Beautiful, Inc. coordinates the annual Great American Cleanup (March through May) via local organizations in 15,000 communities. National sponsors include AT&T Wireless, Pepsi-Cola Co., Georgia-Pacific Corp. and Lysol Brand Products. NeighborWorks, a network of 235 community groups, works with non-profit Neighborhood Reinvestment Corp. and Neighborhood Housing Services of America to provide affordable housing; sponsors include Washington Mutual, Wells Fargo and Citigroup. KaBOOM partners with local parks & recreation departments to build playgrounds (747 and counting); sponsors include The Home Depot, Target, Sprint, Stanley Tools and Ben & Jerry’s.

“KaBOOM and Children’s Miracle Network have figured out a different distribution channel for their product,” says PowerPact’s Sherman. “They’ve cracked the code on not having to set up 50 chapters. And people know that the money is going back into their neighborhood.”

That’s money — and brand equity — well spent.

National Name, or Local Legs?

It’s the cause marketing chicken-and-egg quandary: How much brand recognition does a non-profit need before it’s a prime promotion partner?

It’s crucial to build brand before promoting, argues PowerPact strategist Melissa Radin. “Manufacturers want the non-profit to have a brand consumers already know, rather than putting money into helping it build name recognition,” she says. “Some non-profits have great grassroots components, but until they’re well known, it’s hard to get brands to invest.”

But well-known names are expensive. Coca-Cola committed $60 million over five years to sponsor Big Brothers/Big Sisters. And it gets crowded: General Mills had to wait three years for a national sponsorship slot to open up at Susan G. Komen Breast Cancer Foundation, and another four years for the presenting sponsorship. “These non-profits are so sophisticated, it’s like pitching an RFP” to get a sponsorship slot, Radin says.

Nascent non-profits can be a good starting point, argues PowerPact President Alison Glander. Tums sponsors the First Responder Institute — which helps local fire brigades buy equipment — with a program called Tums Helps Put Out More Fires than You Think. Last year Tums ran FSIs, P-O-P and an account-specific promotion with Walgreens, netting $238,000 in donations for First Responders — and bumped its own volume 16%.

Network

Network