Last month, the Kraft CRM team saw on its internal social listening tool that the topic “green velvet cakes” was gaining steam. It then went to work with its culinary team to create a recipe for green velvet cupcakes to use as content around St. Patrick’s Day this month. The recipe was uploaded to Kraftrecipes.com, published in Tumblr, pinned on Pinterest and was the base for a piece of content distributed in its email to about 4.5 million subscribers.

Last month, the Kraft CRM team saw on its internal social listening tool that the topic “green velvet cakes” was gaining steam. It then went to work with its culinary team to create a recipe for green velvet cupcakes to use as content around St. Patrick’s Day this month. The recipe was uploaded to Kraftrecipes.com, published in Tumblr, pinned on Pinterest and was the base for a piece of content distributed in its email to about 4.5 million subscribers.

“We’re doing things more in real time to help us program content,” says Dana Shank, associate director, CRM at Kraft Foods Group. “When you see something popping in social spaces like the green velvet cakes, it’s in the area that you know we’ll likely do well.”

Gathering and translating digital consumer behavior into effective marketing has taken on new urgency as marketers and agencies work hard to pool as much of that data as possible to pull together a fuller view of each customer, and then personalize and push out relevant offers. Customers expect it. But the challenges—and progress—continue in building unified dashboards so marketers are making the best use of any data point they can pull together.

Kraft has been acting as an online publisher for decades, publishing recipes and tips on its website and more recently on Facebook and Pinterest, which had 10 million unique visitors in December and is now the leading referrer back to its popular Kraftrecipes.com website. Last year, it began posting on Tumblr.

For Kraft, a key digital data ingredient is sifting out from the social sphere, as it did with the “green velvet cupcakes.” Social listening has become an important tool and Kraft combines that data with a wealth of historical data and Google search terms to learn about what’s trending in the world of food and what its consumers are interested in. It then acts on those insights to develop and program content across its vast stable of products.

“It’s that marriage of real-time and long-term trends that allow us to plan in an efficient way,” Shank says.

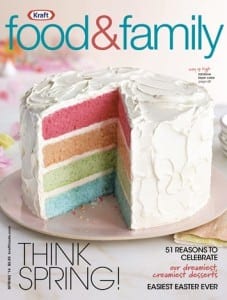

Rainbow Connection

For example, the spring issue of Food & Family, which has 1 million paid subscribers, shows a luscious rainbow-colored cake. The dreamy rose, orange, leafy green and sky blue layers of filling shout “spring!” to the reader. The idea for the image came from working closely with its long-time engagement agency, MXM, which pinpointed search data one year ago around colorful rainbow cakes. That insight was rolled in with the brand’s historical knowledge about its customers and more current social trends. It developed a recipe for the cake and shot the appealing cover photograph.

“The magazine has a longer lead time so we want something that has strong legs that will endure and be more than just a blip on the radar,” notes Peggy Katalinich, content director at MXM. “We can track that because it was something that we saw continuing interest in. There was a strong feeling that the rainbow cake would perform well.”

On a shorter string—and in more real time—trends like the green velvet cupcakes help Kraft pull off a fast one in time for St. Patty’s Day. In January, mini-corn dogs were trending on Pinterest so Kraft thought about how to re-program that for the Super Bowl and NCAA championships. Over the holidays, peppermint terms popped and Kraft had peppermint fudge recipes but no images, so it shot photographs and pushed the content out in its social channels. MXM works on search optimizing the content—a key piece of the marketing—including recipe names and meta descriptions to allow the search engines to surface it. The team watches that content in real time to see what’s resonating and optimizes.

On a shorter string—and in more real time—trends like the green velvet cupcakes help Kraft pull off a fast one in time for St. Patty’s Day. In January, mini-corn dogs were trending on Pinterest so Kraft thought about how to re-program that for the Super Bowl and NCAA championships. Over the holidays, peppermint terms popped and Kraft had peppermint fudge recipes but no images, so it shot photographs and pushed the content out in its social channels. MXM works on search optimizing the content—a key piece of the marketing—including recipe names and meta descriptions to allow the search engines to surface it. The team watches that content in real time to see what’s resonating and optimizes.

“Consumers absolutely engage with content,” Shank says. “The click-through rates are beyond ads. It’s about smart programming and tracking to see where to reprogram and distribute content that is getting the most traction. It’s about flaming those flames in real time because great content will spread like wildfire. Within the CRM team, it’s all around those KPM’s of driving sales.”

Another brand, Bare Escentuals works with HelloWorld to serve seemingly random rewards to members of its “Friends and Benefits,” loyalty program, when in actuality they are far from random. Data gathered from the customer’s registration process includes questions about hair color, eye color, skin tone, favorite products, products they’d like to try and more. Offers and rewards are then served based on that knowledge. “It’s surprise and delight,” says Matt Wise, CEO of HelloWorld, formerly ePrize. “Marketers look at consumer behavior, then serve up a variety of different offers. They don’t know what they’re getting, but the rewards are tailored to that customer’s purchase actions.”

Retargeting is also gaining steam as a way for brands to capitalize on consumers’ digital footprints. Online retailers are serving up digital ads based on where shoppers click on a site or what items they leave in their carts. Say, for example, a shopper leaves a snow blower in his or her cart on sears.com; she might then see ads served up as she’s browsing her favorite sites, offering the same snow blower with a discount from Sears.

“Retargeting campaigns significantly outperform traditional digital campaigns that are not tied to specific consumer data,” says Dan Swartz, senior vice president of digital and analytics at integrated marketing agency Upshot, a 2013 PROMO Top Shop. “Getting the data is one thing but really using it in a positive way is the key.”

Shopper marketing has had a profound shift in the last five years, when origins were about retail marketing and activating in store and through displays and demos,” says Rob Rivenburgh, chief operating officer at Mars Advertising. “But that has evolved with the advancement of technology, now we’re influencing shopping behavior well in advance before they even choose a retailer.”

For its client Allegra and retailer CVS, Mars uncovered a key insight that led to marketing the allergy medication, not on the benefits of it quelling a sniffy nose, but on the strength of the insight that symptoms of allergies affect a woman’s physical beauty and that Allegra is a remedy for that.

“CVS is well known for women who shop there around beauty and cosmetics,” Rivenburgh says. “We leveraged that core insight with the brand and the retailer in a far different manner, not just around allergies, but around beauty.”

Data Dump

Marketers continue to struggle with big data as evidenced by the upcoming IBM Global Chief Marketing Officer Study. IBM, the world’s largest technology company, conducted about 500 in-depth face-to-face interviews with CMOs from companies of various sizes, across a wide range of industries and regions. The study found that feeling the most under-prepared when it comes to the idea of big data rose to the top for even more marketers (82%), than the same concern (71%) in the inaugural CMO study two years ago.

“That’s telling,” says Paul Papas, managing partner of the new IBM Interactive Experience practice. “We expected to see progress over the last two years. It’s the explosion in the volume of data and the data sources contributing to a continued under-preparedness. The space has moved faster than marketers can keep up with it along with the complexity of the analytics that are required to make sense of the data and then put it into action.”

Three main factors are in play for marketers to be better prepared, he says. First, clients recognizing “you can’t go it alone,” and that who you choose to partner with to help achieve the mission is critical. “It’s usually an ecosystem because skills have become so highly specialized,” Papas says.

Second, there is a need to refocus on skill development, how to take your own and your teams’ skills and invest in the skills that are required today and into the future including mobile, digital and analytics. “There’s a lot of combinations of building this new skill set,” he says.

Finally, there’s the concept of speed and rapid iterations. “Test things out. Run pilots really fast, proof of concepts really fast, adaptations fast and stop fast if things aren’t working and learn from it,” Papas says.

Digital Discounts

Kroger has vastly improved its collection of digital data with the launch of its first mobile app late in 2010 with a goal to allow users to load digital coupons directly to customer’s shopper loyalty cards. At Kroger stores—17 brands around the country including Ralph’s and Harris Teeter—90% of register transactions are completed with a shopper card, of which 85% of all U.S. households have one in markets where Kroger operates. Using that transactional data combined with digital coupon redemption, Kroger can now present coupons to the shopper in an order that’s relevant to what people will buy based on what they shop for and what they have already purchased in stores.

“Our focus has been how to make the digital coupons incredibly easy to access and relevant to what the customer is shopping for,” Matt Thompson, director, digital and eCommerce, The Kroger Co., says.

For example, a shopper known to have young children will see baby products rank higher in the coupon list. An older shopper might see items like organic foods. Kroger works with dunnhumby, a United Kingdom-based customer science company, to deliver those coupons in relevant order. Since the app launched a number of capabilities have been added including digital coupons that load next to a customer’s shopping list.

Kroger is also trying new marketing efforts and using digital coupons in very different ways to boost data capture and understand more about its shoppers like the “Free Friday Download,” which offers a downloadable coupon for a weekly free product like the recent offer of a bottle of Aquafina Water.

“We know that our customers who are engaged digitally are more loyal than our average customer; having that digital connection helps us with those customers,” says Thompson. “We’ve had hundreds of millions of digital coupons loaded to our cards. You look at how customers are adopting this and it’s really significant.”

To bring new customers to the app, it runs “Super Sales,” flags downloadable coupons on shelf tags, through online ads on its banner sites and via its social channels. “The past 18 months we’ve really made digital a key part of the Kroger strategy and we’ve got a lot of opportunity ahead of us and we’re looking for customers to help guide us,” he says.

Retailers have a lot to gain from digital coupons, especially when they are personalized for the individual shopper. A 2013 report from Business Insider estimates the number of mobile coupon users will increase to 53.2 million by 2014. In addition to mobile, shoppers are also turning to the web, social media and other channels to access digital coupons. While consumer packaged goods companies typically dominate coupon distribution—in 2012 there were 305 billion CPG coupons, print and digital, distributed in the U.S.

Digital also opens doors to migrate through “futuristic” technologies, such as the indoor positioning system, iBeacon, says Steve Cole, the chief marketing officer at Gladson, a provider of product images, product content and related services for the U.S. consumer packaged goods industry.

Grocers are implementing location-based apps that tell shoppers exactly which aisle of the store certain items are located. On the flip side, grocers have knowledge into where shoppers are located within their stores. Some grocers have also started implementing kiosks that put together menus for shoppers and direct the shoppers to each product’s location. Augmented reality apps are also on the horizon, enabling shoppers to hold up their smartphones and open an app that uses the camera to recognize the product and augment what the customer is seeing to provide recipes, coupons and other value-add engagements, Cole says.

While marketers continue to make the most of any data points they collect, there continue to be any number of efforts to synchronize data collection points, and one company taking on that challenge is IBM.

IBM has taken the lead in driving a standard around digital data collection with the WC3, an international community that develops open standards to ensure the long-term growth of the web. IBM chaired and coordinated a working group that includes Best Buy, Google Blue Cross and Adobe among about 60 others. The first version of its report came out in December, which included digital data collection specifications. The next step is to take the report to a formal WC3 work group, which will set it on the road to become standard endorsed by WC3.

“It’s well on its way to becoming a standard,” says Jay Henderson, IBM global strategy director.