Premium Play Ha-Lo Industries has purchased three premium products companies that will add annualized revenues of more than $52 million to its operation. The Niles, IL-based company bought two private Los Angeles-based firms, Premium Promotions and Marketing, Inc., and Idea Man, Inc., along with Smith Advertising Specialties, Inc., a Harrisburg, PA, promotional products company.

Ha-Lo’s sales for the nine months ended Sept. 30 were $396 million, 29 percent higher than the previous year. Its net income for the three quarters was $12.6 million, 52 percent above last year.

The company recently named Michael Linderman executive vp-promotional products, a new post that has him overseeing Ha-Lo’s various promotional products divisions.

Premier Promotions and Marketing, Inc. develops consumer-oriented promotions, primarily outside the U.S., for firms such as Gillette, Kodak, and Colgate-Palmolive. Idea Man, Inc.’s clients in California include Acura, Packard Bell, Sony, and Virgin Records.

Lou Weisbach, Ha-Lo president and ceo, says the buys continue the company’s “focus on growing our core business through consolidation of the promotional products industry.”

Ha-Lo is now the largest promotional products company in California, which is the largest promotional products market in the U.S., Weisbach says.

Ha-Lo bought Upshot last year in its quest to build integrated brand marketing services.

A Good Fit Moving to build its promotion agency business, Gage Marketing Group has signed a letter of intent to buy Mayer-Douglas, Inc., a Minneapolis shop that is agency of record for Conagra’s Healthy Choice and Banquet brands, and Hunt-Wesson’s Orville Redenbacher and Swiss Miss brands.

Mayer-Douglas will give Minneapolis-based Gage expertise in strategic promotional planning and creative concept development.

Last year, Gage sold 85 percent of its executional division – Gage Marketing Support Services – to AHL Services, Inc., Atlanta, intending to use the capital to shop for top promo companies.

“[Mayer-Douglas’s] strategic packaged goods strength is a wonderful fit with our broad-based promotion, direct response, and Internet business,” says Gage chairman and ceo E.C. “Skip” Gage.

Led by president Randy Mayer, the seven person shop had $40 million in capitalized billings last year. The group will move into Gage’s offices.

Since starting out seven years ago, Gage has grown mostly in “back-end” services. It’s largest account is Ford Motor, for which its handles fulfillment. Gage earned spot number 50 in promo’s 1998 agency ranking with $123.6 million in net revenue.

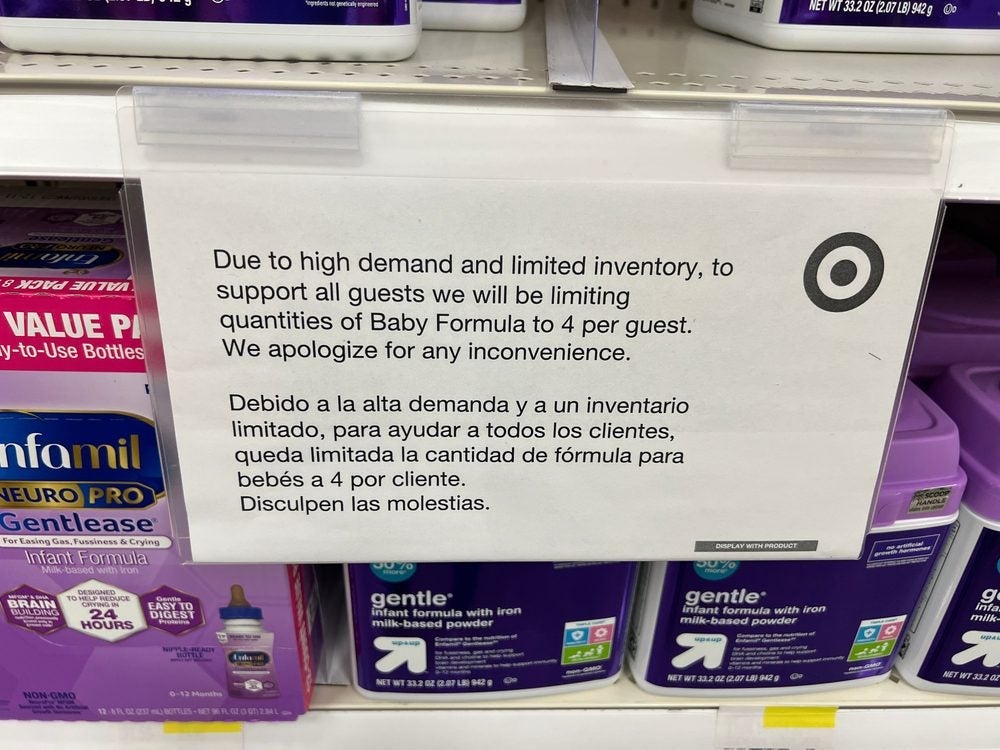

Ambush League Former Ziff-Davis Publishing Co. president Hershel Sarbin and his son, Richard Sarbin, have formed Sarbin Performance Audits, New York, to help corporations and retailers audit on-site compliance of promotions. SPA is a subsidiary of Market Development Co., founded by the younger Sarbin.

SPA will use a network of reps to guarantee on-the-scene compliance, the founders say.

“This is something the industry has needed for a long time. Millions of dollars are wasted by sponsors who assume that, at retail level, they will receive what is promised,” said Dennis Gorg, president of St. Louis-based Events Group, Inc. Noting that compliance rates can dip as low as 20 to 30 percent, Gorg said SPA will help deter ambush marketers.

Network

Network