When it comes to driving the most value from rapidly expanding shopper-centric analytics, manufacturers and retailers would do best by sharing the front seat.

Leading CPG companies have been enhancing their analytical expertise for years, investing heavily in richer sources of shopper data and the talent required to decode it. Retailers, meanwhile, are leveraging their shopper insights in the quest for deeper intelligence and are rethinking their marketing and merchandising strategies to target their highest-value shoppers. Where the two can come together is in viewing the challenges ahead through the common lens of that individual shopper.

But before collaborating to push the boundaries of product-centric thinking, retailers and manufacturers must first achieve a meeting of the minds around common goals and the clearest routes for reaching them. Using these steps, CPG companies and retailers can transform data-driven intelligence into higher incremental sales, greater market share and more profitable shopper relationships.

Start from the shopper’s point of view

Manufacturers have excelled at analyzing shopper preferences and brand attributes—determining, for instance, whether people would be more inclined to buy microwavable entrées if they included different ethnic cuisines.

But more and more retailers are interested specifically in their most loyal and valuable shoppers, and what motivates them to buy one brand over another, or to shop the category at all. Using transaction-based data, a shopper-focused retailer can identify essential groups among its best shoppers, such as time-starved large families looking for quick and easy weekday meal solutions.

From there, close analysis of the basket will reveal which actions might motivate these shoppers to buy more, or how to attract other shoppers within this segment. This in turn may lead to product-specific decisions around cuisine and serving size.

Target a retailer’s highest-value segments

So how does a CPG company go to market with a portfolio of brands when retailers are segmenting and focusing on high-value shoppers? The answer is to first prioritize to make the work practical. Manufacturers should select a few of their best retail clients and work closely with them to leverage each of the retailer’s shopper data.

This is an opportunity for manufacturers to use their own analytical horsepower and become trusted advisors to their retail clients. Such a relationship could open doors to conversations they wouldn’t have been privy to before. For example, the expert analytics can help retailers identify essential behavior within a measured tier of best shoppers. These high-value shoppers may show a surprising lack of price-sensitivity in some categories, for instance.

Forge a stronger dialogue on strategy

In turn, manufacturers—by working alongside retail clients and incorporating their shopper data—can exert more influence on pricing decisions, accelerate the pace of assortment changes and raise the overall ROI on promotional spending.

To work together effectively, manufacturers and retailers have to overcome any past hesitation to share proprietary data. The question that counts is: “What are we going to do together to win those crucial shopper segments?” Unless that win is three-way, with the shopper front and center, everyone loses.

Move beyond traditional forecasting

But the full impact of their strategy only becomes clear when retailers and manufacturers focus on where it translates to tactics—in the aisles and on the shelves.

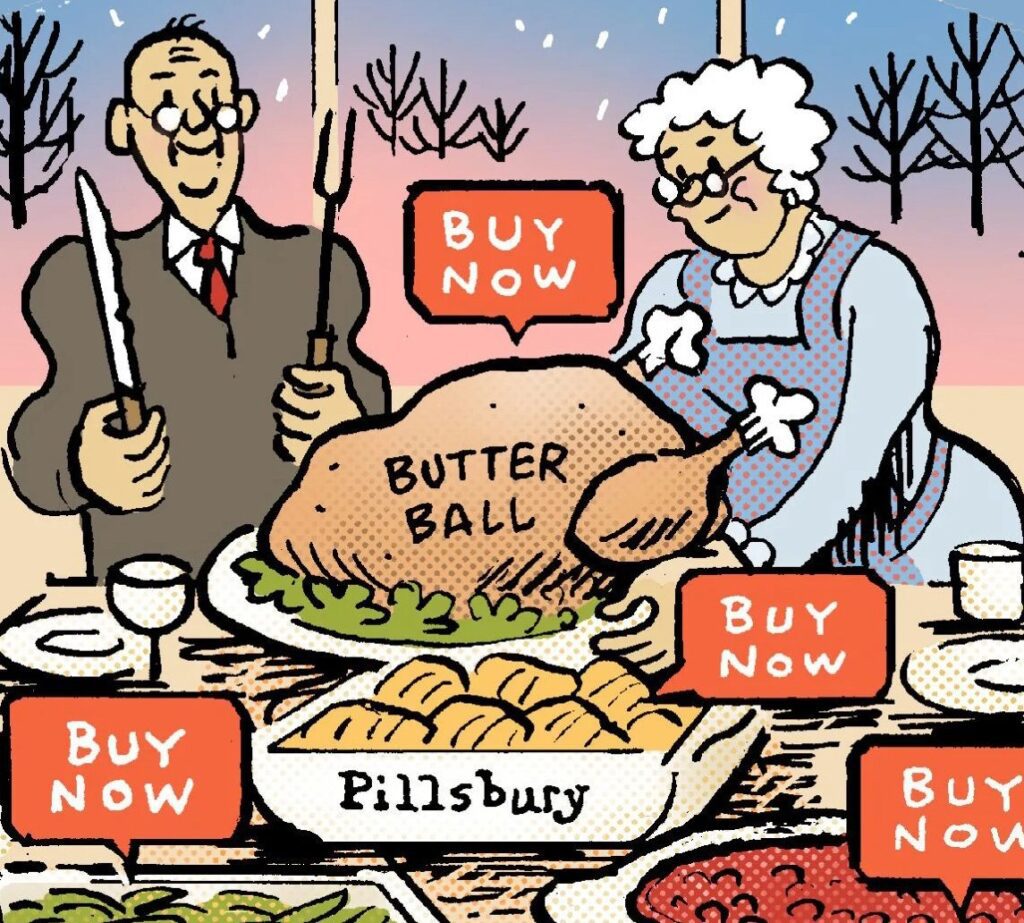

It is crucial to understand who is buying what and why. In the old world, a promotion for cheese would be keyed to the forecasted sales at each store. In the new world of shopper insights, a promotion might focus on specific cheese varieties and pair them with, say, gourmet olive oils—because that is what will most likely attract high-value shoppers.

So while classic tactical promotions may get immediate results, long-term benefits come from truly understanding how a retailer’s best prospects seek solutions, instead of simply buying products.

Use shopper-focused insights to fine-tune the ticket

Pricing is not the challenge it once was, thanks to software that enables retailers to calculate elasticity and correlate that information with cost and inventory to arrive at ideal pricing strategies.

Now these powerful analytical tools can be augmented with shopper-focused data to bring even more precision to forecasts and planning. For instance, analyses have shown that 20% to 50% of the items on a retailer’s shelves have no price sensitivity among best shoppers. If retailers index important value items simply to meet or beat competitors’ prices, they risk throwing away margin with no appreciable benefit. Manufacturers can weave the same understanding into their pricing.

There is general acknowledgement that the old ways of marketing will not suffice anymore. As retailers and manufacturers work together to meet new marketplace realities, they’ve begun redefining their own partnerships. Together, they’re finding new ways of aligning brand strategy with retail strategy to realize exponential gains—all thanks to a simple but monumental change in deciding which question comes first.

For retailers, the question was: “What do the weekly sales reports show?” And for manufacturers: “What does the research suggest?”

Now they can ask together, “What will get the attention of the shoppers who matter most—to both of us?”

Brian Ross is general manager at Precima. He can be reached at bross@precima.com. Win Weber is chairman and CEO of Winston Weber & Associates Inc.. He can be reached at winweber@winstonweber.com.