E-mail lists aren’t the only prospect sources costing a pretty penny: An insurer specializing in the SOHO and small business market charges its field reps around $15 per telemarketing lead.

No, that isn’t a misprint – “per thousand” wasn’t carelessly dropped from that first sentence. The trick is the leadsrented have been pre-screened, both as responding to telemarketing calls and having a need for insurance.

Here’s how it works: UICI Marketing, a Dallas-based financial services company, gathers a mix of names from compilers and response lists. After deduping and merge/purging against a 3 million name “do not promote” file, telemarketing service representatives in UICI’s 200-seat operation call each prospect and ask a series of qualifying questions regarding their insurance use and general front-office needs.

>From one call, the company receives a lot of information. In addition to >qualifying questions, such as confirming the prospect’s name and address, >collecting e-mail addresses (the company has half a million on file), >determining whether they have insurance and operate a small business, the >company notes when the prospect answered the telephone.

After this initial screening, the bulk of the names are rented out to one of two UICI membership groups. The first is the National Association of the Self Employed, which sells membership (and the insurance benefit) to self-employed prospects, or those who own their own small businesses. The second is the Alliance for Affordable Services, which targets people who pay for their own insurance, regardless of their employment status. UICI’s executive vice president of telemarketing Cliff Merle estimates he generates between 8,000-10,000 pre-qualified leads in an average week – and his leads are in the hands of the in-field sales associates within four days of the initial call.

But another set of leads is turned back over to the company’s in-house call center. These are people who have insurance, and therefore are of no value to the field sales force, but indicated interest in other front-office services.

Add-On Campaigns

Past offers have included credit card processing, Internet site facilitation and long distance telephone service, all of which are offered through a UICI-affiliated companies. Testing has shown the ideal time to recontact these individuals is 24 hours after the initial contact – as close to the time of the first call as possible.

In one “add-on” campaign for long distance services, the prequalifying questions allowed UICI call center representatives to determine which of two pitches to use during follow-up calls. If a prospect indicated monthly long distance bills of $20 or more, they were offered the opportunity to switch providers. But UICI offered prospects who said they spent more than $50 a month a chance to fax their current bill to UICI headquarters for a real-time savings analysis.

The call center averages a contact rate of 35%, as opposed to an industry standard of 18%-20%, due to the quick turnaround time, coupled with the knowledge of when to reach the prospect. In addition, when prospects opt to receive more information, they have a predilection to purchase: These prequalified leads generate around a 3.5% sales rate.

During some qualifying calls, reps have identified characteristics indicating the future value of a current name, such as an individual who is insured through an employer but is planning to retire soon. UICI stores this information in a “tickle” file, and acts on it when an appropriate opportunity arises.

Even the company’s “do not promote” file will ultimately have some strategic value. A significant portion of the names in it were placed there because UICI’s reps found that the businesses had more than five employees. While this disqualified them as a viable UICI lead, the company has retained their names, and will look to create a market for them in the future, or rent them to other service providers. UICI sees its database of prequalified leads as a service it offers to its sales associates at near-cost, according to UICI president Jack McCarty. The company makes its money on the sale of association memberships, insurance and other services.

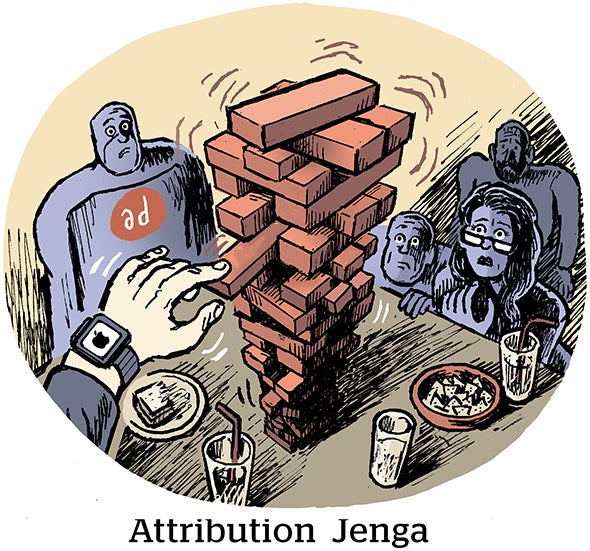

One of the more frustrating elements for McCarty is the inability to precisely gauge the effectiveness of each lead. Sales associates are not required to link an order for insurance ora membership application back to a specific lead, making it nearly impossible for McCarty to determine which lists provided the best prospects.

“When you can answer that question,” he says, “I will pay you.”