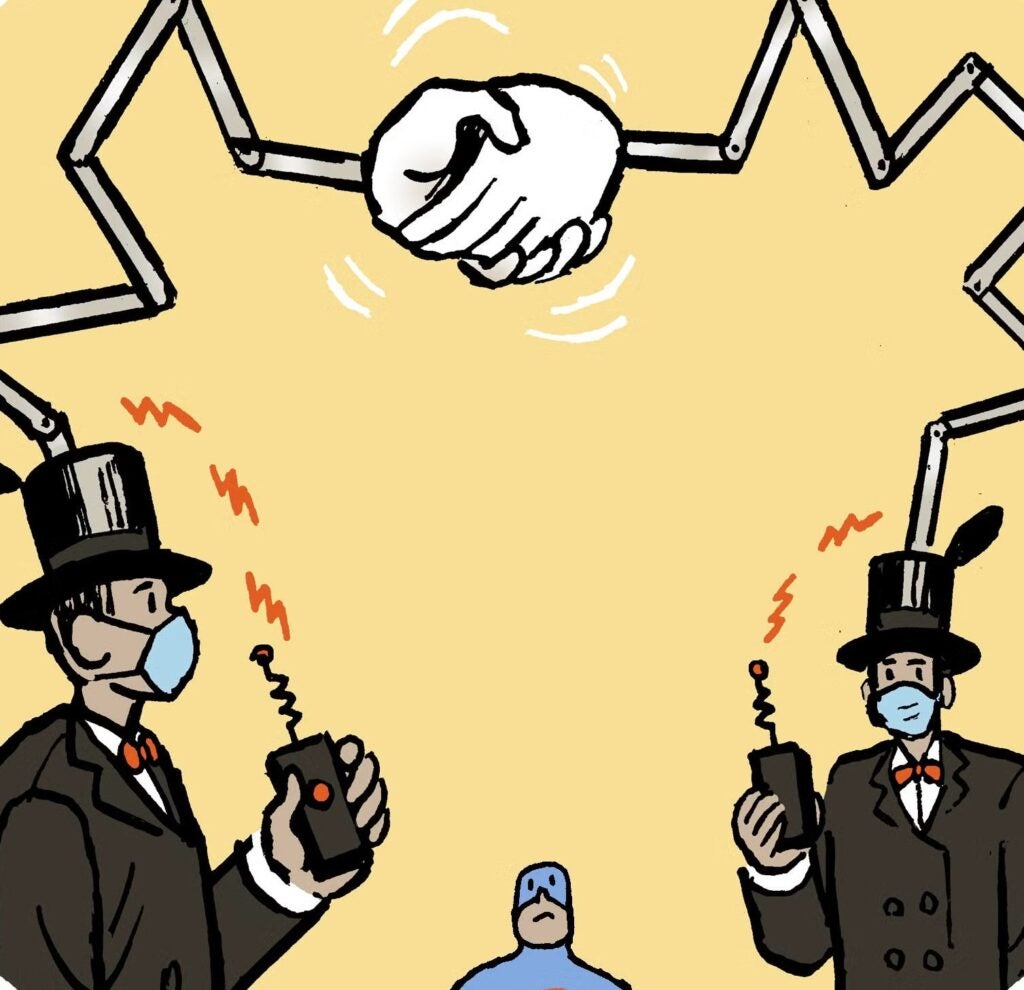

The Federal Trade Commission and six other government agencies Monday endorsed a proposed rule change by the Federal Reserve Board to allow banks, financial institutions and credit grantors to collect, use and share additional personal information about their customers under the Equal Credit Opportunity Act.

Credit grantors would be allowed to “voluntarily” collect, use and share such personal data as race, sex, and other personal characteristics, including the spending habits and credit worthiness of individuals seeking non-mortgage related consumer and business loans, or responding to pre-approved direct mail loan solicitations under the proposed change.

Banks, financial institutions and credit grantors are currently prohibited from collecting, using or sharing that information under existing Federal Reserve rules.

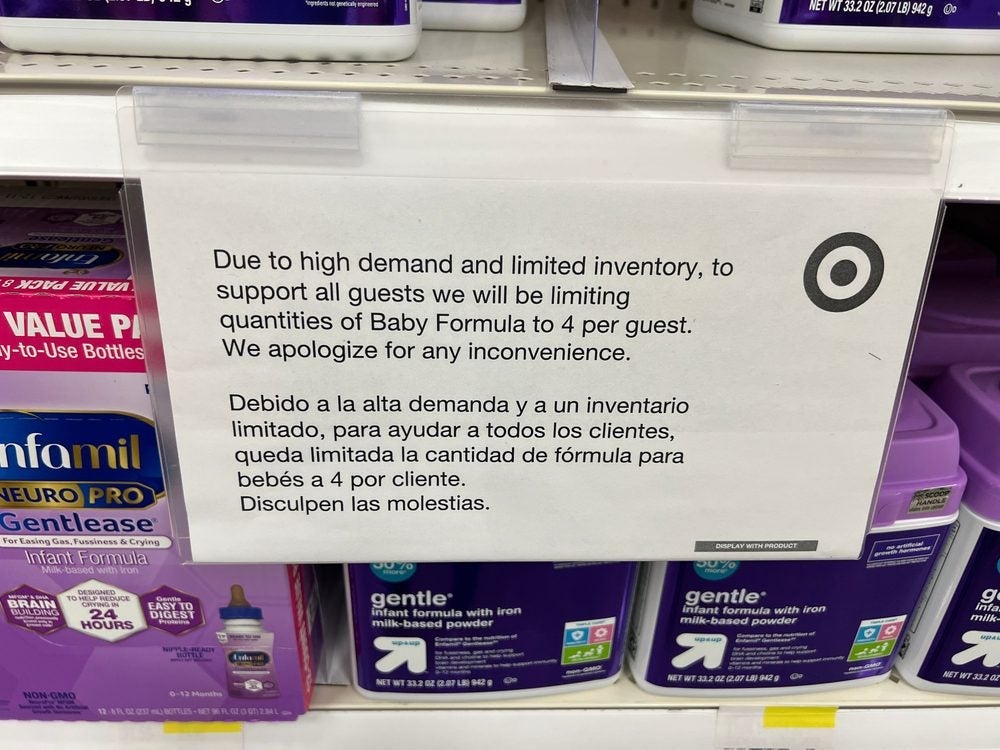

Other proposed changes would prohibit discrimination in credit offerings; require credit grantors to maintain detailed record of all “pre-approved credit solicitations, and permit credit grantors to “design new products to reach consumers who may not meet traditional credit standards due to credit inexperience or the use of credit sources that do not report to credit bureaus.”

According to a spokesperson, Federal Reserve Chairman Alan Greenspan was unable to predict when the board would act on the proposed changes, only saying that “it might be soon.”

Joining the FTC in endorsing the proposed rule changes were the Treasury and Justice Departments, with the Department of Housing and Urban Development, the Comptroller of the Currency, Office of Thrift Supervision, the Small Business Administration and the Office of Federal Housing Enterprise Oversight.

“Allowing creditors to collect race, gender and certain other data for business and consumer loans will likely lead to innovation and increased access to credit, a greater level of voluntarily compliance [with other regulations], and [a] more effective fair-lending enforcement,” the seven said in a joint statement.

Permitting the collection, use and sharing of such information will make it easier credit grantors “to know whether products intended to expand access to credit, including to minorities, reach their intended customer base,” they said.

Also it would abolish a “regulatory prohibition [that] inhibits the ability of financial service providers to learn about and respond to market opportunities to provide credit for underserved communities” with new, special purpose credit programs geared to people with little or no credit experience while addressing the government’s concerns about the failure of some sub-prime creditors to report credit information about certain of their customers.

Network

Network