When growing up, and admittedly even to this day, if asked what I want to do when I grow up, the answer would involve cars, preferably racing them. Having more traditional parents, such a dream received no encouragement. The closest they came would involve mentioning how Walter Payton or Paul Newman had raced cars as a follow-up to a first career. In other words, do something successful and then you might get to indulge. And, to their credit, I think, that lack of support postponed any action towards achieving my "dream job," but it didn’t put a damper on my love for cars, a love that meant many car magazine subscriptions and frequent trips to dealers to see the cars. Yet, in all the visits to the car dealerships and the continued love of cars, I can’t say it ever occurred to me to think about the potential similarities between car dealerships and affiliate advertising. It wasn’t until a recent question by a good friend did the possible connection come to mind. He asked, "Why would car manufacturers close a dealer when they get paid on performance? Isn’t it like turning off an affiliate that just has seen volume decrease? Does anyone do that?" A simple question, but how simple is it to answer?

Big 3. Now, Just 3

For those not following the collapse of the American car industry, three companies once reigned supreme, with all three being U.S. based businesses – General Motors, Ford, and Chrysler. Much has been written about Ford Motor Company and its founder Henry Ford when he made the automobile available for the masses. After a tussle in the late 1920’s, General Motors took the lead from Ford as the dominant auto maker in 1931, and by the 1960’s claimed an almost 50% share of the U.S. auto market, still the world’s most important auto market by volume. The numbers started to slide in the 1970’s but it wasn’t until the mid to late 1990’s that they fell off a cliff, for all of the Big 3. In 1996, the U.S. auto market share looked something like this GM – 34%, Ford, 26%, Chrysler 15%. The Big 3 still looked like the Big 3 and accounted for roughly 65% of all cars sold in the U.S. In the decade that followed, their market share started to look like Microsoft and Yahoo’s share of search when Google entered the market, with the Japanese automakers eating up much of what the Big 3 gave up. Toyota in particular gained the most ground, surpassed Chrysler and Ford in 2006 and GM in the beginning of 2009, after besting their 2008 sales, to become the largest seller of cars in the United States. GM’s share in 2009 might hit 18%, Ford’s 17%, and Chrysler 12%, with 2009 being the last year that domestic brands outsell foreign-owned brands in the U.S.

Too Many Dealers?

It’s tough enough to be a car dealer trying to sell a product that fewer and fewer people want, let alone to now hear that the products you have supported might want to close you down, but that is the current situation with GM and Chrysler. Not that dealers have needed the brands to tell them when enough is enough, as even some of the largest networks of dealers have shuttered their doors amid the almost two-year old car buying slump. Roughly 15,000 car dealers dot the U.S. landscape, and that number doesn’t include any brands outside those made by the U.S. Three. That 15,000 who employ more than 100,000 people will drop in number. In May as part of their plan to return to profitability, GM and Chrysler announced they would shutter 1,100 and 800 dealers respectively who combined sold roughly 200,000 units annually. One of those dealers, a profitable one serving a poorer area of Chicago, doubts the logic that cutting dealers makes business sense. Analysts on the other hand, have long felt that American companies have an excess of dealerships. As covered by the Heritage Foundation in a recent report, GM has approximately 6,000 dealers nationwide, Chrysler more than 3,000 dealers, while Toyota, who outsells them both, has only 1,240 dealerships, which translates into 497 cars per dealer sold for GM in 2008, 475 for Chrysler, and 875 for Toyota.

Why Now?

Dealers claim that they don’t cost the manufacturers money. They buy the inventory, own / lease the land, buildings, pay for staff, etc. It’s a big investment and can be big business, just ask Red McCombs, whose network of auto dealers in Texas provided the funds for him to own the San Antonio Spurs and New Orleans Saints. As a result, dealers have received favorable treatment from state franchise laws. It is these laws that prohibit car manufacturers from selling cars directly to consumers, including over the Internet. An article in the Washington Times says, "Over the years car dealers have succeeded in persuading state legislatures to pass a wide array of anti-consumer laws that protect car dealers at the expense of consumers, and ultimately at the expense of the health of the U.S. auto industry." And, "Perhaps more than any other industry, automobile dealers have succeeded in using public policy to limit competition. From laws that effectively prohibit new dealerships within a designated radius of an existing dealership selling the same make auto, to restrictions on warranty repair work or offering other auto-related services to consumers, including financing, insurance, and parts, to prohibitions on automobile manufacturers selling cars themselves – car dealers epitomize anti-consumer protectionism."

As for the manufacturers themselves, again, from the Heritage Foundation analysis, "although the dealerships are owned independently, they receive financial support from GM and Chrysler through a variety of mechanisms, ranging from low-cost financing for vehicles in inventory to local advertising assistance. GM estimates that it will save some $2 million in such costs for each dealer closed. Second, and perhaps even more significantly, a surplus of franchises means dealers for the same manufacturer end up competing among themselves, resulting in lower returns across the board. With less revenue, not only do dealers need more assistance from the manufacturer, but they find it harder to maintain service and quality levels." All of which leads to the natural question of why now if it’s been a problem for a long time? Bankruptcy. The restrictive state laws go out the window once a company enters bankruptcy.

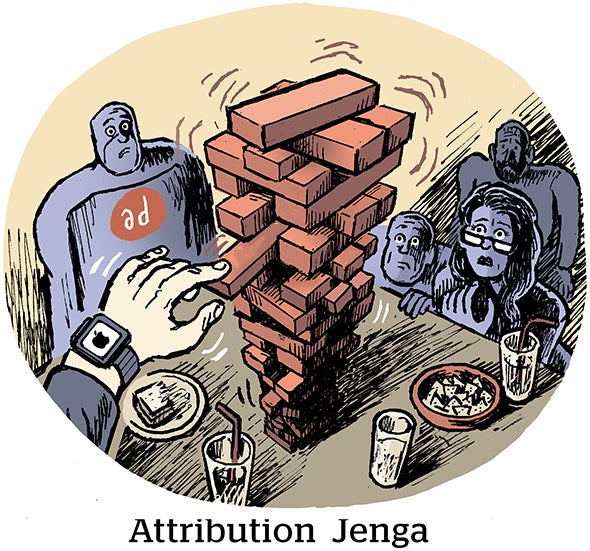

The closing of the dealers will certainly impact some profitable dealers and some consumers who had a dealer close, but the dealers, while paid on a performance basis for promoting someone else’s products, aren’t a parallel to the world of affiliate marketing. If anything, it is almost the reverse. Affiliate marketers are being driven out of business by state laws, whereas affiliate car sellers had numerous laws to help them stay in business. And, while affiliates receive support from the company’s and networks whose products they promote, they don’t receive anywhere near the level of support that the dealers did. But, then again, affiliate and performance marketers don’t have to keep millions of dollars in inventory lying around either… or want visitors to their office.