Call it the “new black” of marketing. Mobile seems to be integrating into campaigns of all types, and in fact is being used more as a bridge for cross-platform campaigns and less as a channel on its own.

Call it the “new black” of marketing. Mobile seems to be integrating into campaigns of all types, and in fact is being used more as a bridge for cross-platform campaigns and less as a channel on its own.

That’s one finding from the latest version of the Chief Marketer Mobile Marketing Survey. Marketers tell CM that they are getting their messages into mobile primarily as a way to drive prospects or audiences to campaigns taking place elsewhere. Whether it’s a video that’s meant to be shared via social channels—increasingly accessed first on mobile devices—a QR code that drives commuters to a web site, or an SMS campaign sending out offers to be redeemed in stores, mobile is becoming the connective tissue whose most important role today is holding multichannel campaigns together.

“Everyone’s got a phone and keeps it close most of the day,” said one respondent. “Depending on your aim, you can reach a mass audience or one as targeted as a specific town, block or street. That makes mobile flexible and useful in ways other channels can’t manage.”

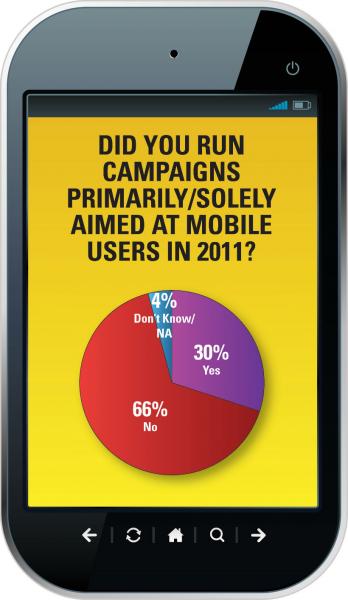

Fifty-seven percent of all survey respondents said they integrated mobile elements into their marketing last year, against 39% who said their brands did not use mobile, and 3% who did not know. (Figures don’t always total 100% due to rounding.) But only 30% said they ran self-contained or mobile-specific campaigns last year, while two-thirds of those polled did not. So for most of those who deployed campaign elements in mobile last year, the channel was a tactical asset rather than a strategic one.

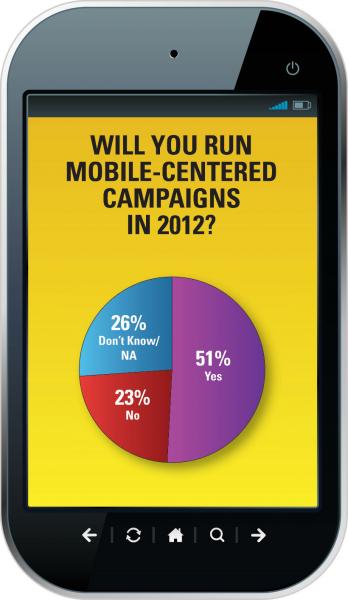

But that pattern might change, and soon. More respondents (51%) said they plan to run more mobile-only marketing this year. And more than a quarter of those polled (26%) said they are at least undecided about whether to run a mobile-centric campaign in 2012, possibly adding to that 51%.

Those results suggest that mobile is morphing from a helper technology that makes other campaigns work better into a standalone, standout platform star in its own right—while retaining its capacity for providing “assists” for goals scored in other media.

Budgets and Basics

A rising profile for mobile doesn’t mean, however, that marketers will be spending much more in the channel, or doing much to understand how their prospects use mobile. While 31% of respondents said their budgets for mobile marketing grew in 2011, that’s almost equaled by the 28% who said those dollars remained the same. (Only 3% saw a decrease.) And more than two-thirds of those polled (71%) said that a tenth or less of their 2012 marketing spend is allotted for mobile. For 50% of respondents, that will translate into $5,000 or less.

In terms of knowing their mobile users, about 25% said they know from first-hand observation how their customers use mobile and what devices they use, and can segment those users based on behavior and interests. Another 18% said they don’t have that direct knowledge drawn from their own data, but rely on third-party studies and research.

And 40% said they’re just assuming that their target consumers are using mobile more, but have no firm insight into what devices they’re on or what they do there. Basically, this 40% is guessing, up from 35% who said the same thing last year. Add to that the 13% who said they just don’t know what shoppers are doing and it becomes clear: More than half of marketers need a better understanding of where their customers are in the mobile migration.

Optimization Is Not Optional

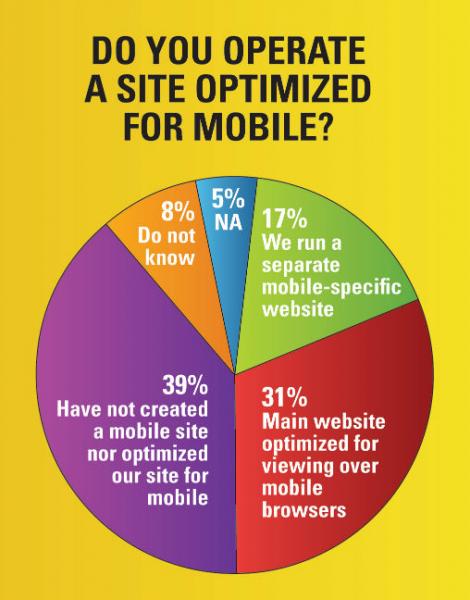

Most analysts said that mobile as a viable marketing channel starts with optimizing the website for viewing over the mobile browser. If that’s the case, marketers seem still to be trying to skimp on the foundations of their campaigns. About 31% said their brand’s main website has been optimized for viewing over most mobile devices, and 17% report that they run a separate version of that site built for mobile visits. But a good 39% said their brands haven’t optimized for mobile or developed a WAP site, and another 8% don’t know their mobile optimization levels. Those figures are only slight improvements over the 43% and 6% who gave the same responses last year.

Most analysts said that mobile as a viable marketing channel starts with optimizing the website for viewing over the mobile browser. If that’s the case, marketers seem still to be trying to skimp on the foundations of their campaigns. About 31% said their brand’s main website has been optimized for viewing over most mobile devices, and 17% report that they run a separate version of that site built for mobile visits. But a good 39% said their brands haven’t optimized for mobile or developed a WAP site, and another 8% don’t know their mobile optimization levels. Those figures are only slight improvements over the 43% and 6% who gave the same responses last year.

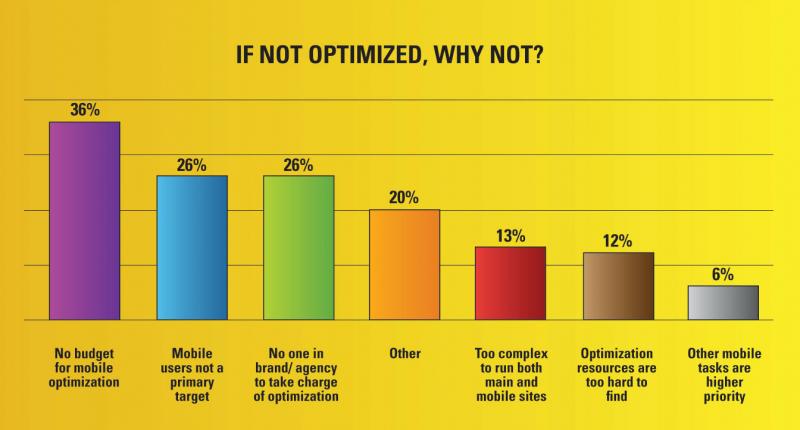

Why not optimize? No budget, said 36% of those with un-mobile websites. But other factors were almost as important as costs, including not seeing mobile users as a primary target (26%) and not having anyone at the brand or in its agency to champion the drive to mobile (26%).

This failure to adapt starts to look a bit willful when CM asked if respondents monitor their email messaging campaigns to see how many recipients are opening mail on mobile devices—a fairly easy task. Only 36% said they’re watching those mobile opens, compared to 45% who don’t (and 14% who don’t know).

Of those who do know their email open rates via mobile, a solid 72% said they’re optimizing those messages for the mobile browser.

Tools, Texts and Apps

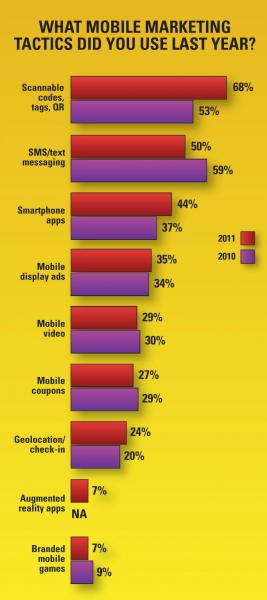

The roster of mobile marketing tactics keeps expanding, which explains why this time last year CM did not bother to ask how many marketers had deployed augmented reality in the previous year. But some of the usage trends are clear enough. Scans of barcodes and QR codes are up 15 percentage points over the last survey, to 68% of the responders. Smartphone apps have also seen a sizable lift, to 44% of respondents, given their once-prohibitive upfront development costs. Mobile ads, video and coupons have all held virtually steady at roughly 30% to 35% of those polled.

The roster of mobile marketing tactics keeps expanding, which explains why this time last year CM did not bother to ask how many marketers had deployed augmented reality in the previous year. But some of the usage trends are clear enough. Scans of barcodes and QR codes are up 15 percentage points over the last survey, to 68% of the responders. Smartphone apps have also seen a sizable lift, to 44% of respondents, given their once-prohibitive upfront development costs. Mobile ads, video and coupons have all held virtually steady at roughly 30% to 35% of those polled.

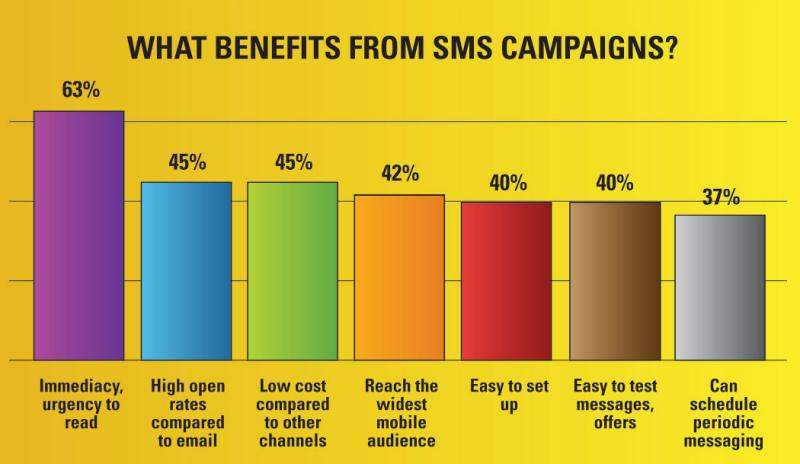

Interestingly, SMS messaging declined 9 percentage points from 2010 through 2011, although it’s still used by half of mobile marketers. Asked why they use text messaging for their campaigns, the marketers who did so most often (63%) pointed to its immediacy and urgency for users; research indicates that text open rates are as high as 90%, and most messages are opened within eight minutes of arrival. Other factors included superior open rates to email (45%), low cost (45%) and access to the broadest mobile audience (42%).

This year, 37% of respondents told CM they offer at least one smartphone app or plan one for 2012, compared to about 25% who said the same in the last survey. Of those, most said they are targeting apps for Apple’s iPhone (94% have one) and iPad (72%), although about three-quarters also said they’ve got apps planned for the Android platform.

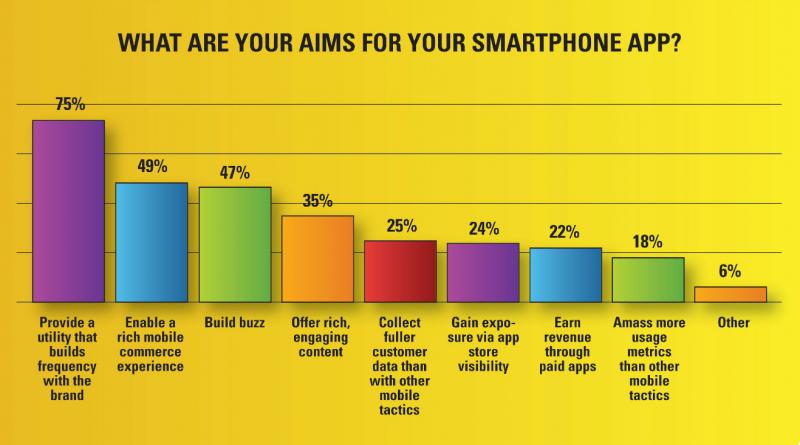

As for the strategy behind all this app-making, the primary aim for most marketers (75% of those offering apps) is to give customers a utility that they will use often or with intensity on their phones, followed by the chance to give users rich, engaging content (49%). And don’t forget the buzz benefits that come from a flashy or entertaining app (47%). Mobile commerce (35%), rich usage data (25%) and discovery in mobile app stores (24%) all trail these reasons.

As for the strategy behind all this app-making, the primary aim for most marketers (75% of those offering apps) is to give customers a utility that they will use often or with intensity on their phones, followed by the chance to give users rich, engaging content (49%). And don’t forget the buzz benefits that come from a flashy or entertaining app (47%). Mobile commerce (35%), rich usage data (25%) and discovery in mobile app stores (24%) all trail these reasons.

Everything but the Sale

As mentioned above, the distinction between shopping and buying is meaningful in mobile commerce. Among the subgroup of 500-plus survey respondents who sell products or services directly to buyers, only 27% currently run mobile sites that let visitors complete purchases, and another 22% plan to introduce transactions. That leaves 51% who don’t sell directly through mobile.

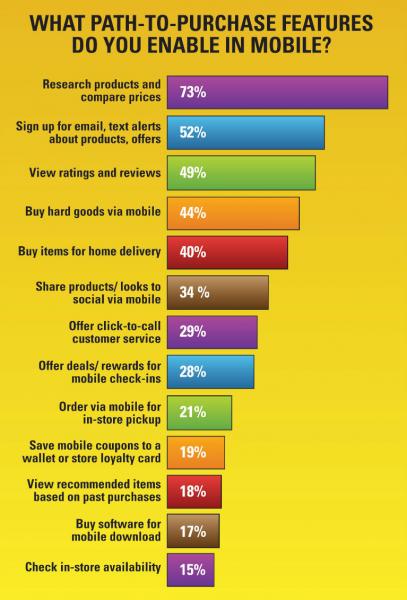

But that’s different from preventing visitors from shopping on their mobile sites, and doing a lot of the important research and comparison work at the wide end of the purchase funnel. Fully 73% of those direct sellers expect mobile visitors to use their sites to research items and shop prices, while half let them sign up via mobile for emails or alerts about products or offers, or to look at ratings/reviews from other shoppers.

Other popular mobile tools for pre-purchase include the ability to share looks or wish lists to social pages via mobile (34%), offering click-to-call ordering or customer service (29%), and using check-in offers or rewards to get browsers into a store or other target (28%).

One of the least available mobile commerce features is one requested by almost three-quarters of customers polled in a MyBuys.com/e-tailing group survey in June 2011: the ability to check local stores for inventory of a particular item. Seventy-two percent of customers told MyBuys.com that they wanted that feature; only 15% of the direct sellers in the Chief Marketer survey said they currently offer it.

Asked to identify the primary obstacles to mobile marketing in their sectors, respondents volunteered a litany of problems and pain points—from lack of funding or in-house talent to complex B2B buying processes to cultural resistance to mobile in sectors such as banking. But return on investment continues to be a primary worry.

“Mobile is additive and layers onto other campaigns,” wrote one respondent. “Makes it hard to separate the ROI for mobile ads or other marketing efforts from the campaigns we already run on the web.”

A fuller discussion of the results of this survey, including the study methodology and data not published here, will be available as a .pdf download by mid-June on the Chief Marketer website at www.ChiefMarketer.com/research. (Registration required.)

Network

Network