Writing about major acquisitions is among the best topics to cover. They provide a great opportunity to research companies in order to better understand the factors behind the sale. One such sale was Intermix, a company snatched up by Rupert Murdoch’s News Corp. less than two weeks ago. Unlike many of the recent sales, including several in the hundred million dollar range, Intermix stands alone in their having already been a public company prior to the sale. As such, much more existed regarding their financial, and other business activities, than tends to exist with private companies.

Most public companies disclose only the requisite financial information, leaving the rest of us to infer the behind the scene’s drivers. This certainly applies for this week’s batch of earnings announcements from search giants Google and Yahoo and ecommerce powerhouses Amazon and eBay. In this week’s Trends Report, we cram four articles worth of earnings report into one action packed review of these billion dollar companies’ second quarter performances. At an average of $1.3 billion dollars in revenue for the quarter, a little simple math shows these companies earn on average more than $400 million per month or $10 million dollars per day in revenue.

The first of our billion dollar businesses is Amazon, whose revenues rose from $1.39 billion to $1.75 compared to their second quarter one year ago. While this increase roughly equals the amount of revenue generated from their 1.5 million advance order purchases of the most recent Harry Potter’s book, analysts chose to highlight Amazon’s increased gross profit. Amazon calculates gross profit as revenue minus their cost to buy products, and that number increased 32% to $450 million, up from $341 million. The company’s overall net profit dipped lower than the same quarter last year, $52 million as opposed to the previous $76 million, but that difference can be attributed to a non-recurring tax expense. Were the expense not there, net profit would have grown by almost 50%. Amazon’s CFO attributed the lift in profit to increased sales through their independent merchant channel which offers other sellers the ability to get listed on Amazon and leverage their traffic strength. It is no doubt to be a continued focus as Amazon still earns a percent of each sale but avoids their biggest cost, shipping.

Not to be outdone by the almost ironic book-company-named-after-a-forest, eBay, beloved since its 1998 IPO, also impressed those on Wall Street with its recent earnings report. The company had taken a little heat not too long ago after many wondered whether it could sustain its impressive and rising earnings. At $292 million dollars, eBay pulled in $100 million more in profit than it did for the same time period last year. Their revenues too, also increased, up 40% to $1.09 billion. Similar to Amazon, they too raised their full year outlook, in this case predicting revenues of $4.4 billion. Almost as important, these results help counter a series of bad news during the first quarter including disappointing earnings, announcements of fee hikes, and significant noise from buyers and sellers regarding fraud. Wall Street and eBay’s competitors alike will be watching the company carefully to see whether this quarter’s positive results came from the increased fees or as indicated by eBay growth in its buyer and seller base.

Sometimes growing revenues and meeting earnings targets isn’t enough. That was the case with Yahoo, which saw a few hundred million dollars in market capitalization disappear after their recent earnings announcement. The company that is in a “constant state of invention” according to its CEO Terry Semel saw US revenues reach $870 million and international revenues top $383 million. Those represent a 39% and an 84% gain respectively. Despite the solid increase in branding advertisers and their impressive international expansion, analysts and investors only want to know how Yahoo compares to Google in search. Yahoo has 30% of the search query market, and has not closed the gap recently compared to Google’s 37%. Additionally, Yahoo does not earn as much per search as Google despite having a higher average CPC, a sign that Google’s performance pricing strategy does produce better returns. To keep pace Yahoo is hard at work on unveiling a revised platform that will most likely take click through performance into consideration. Yahoo was also dinged for their steep rise in traffic costs, which put a stain on their sharp rise in revenues. Don’t count them out though. The company still expects to earn around $3.7 billion in revenues and more than $1 billion in profits this year.

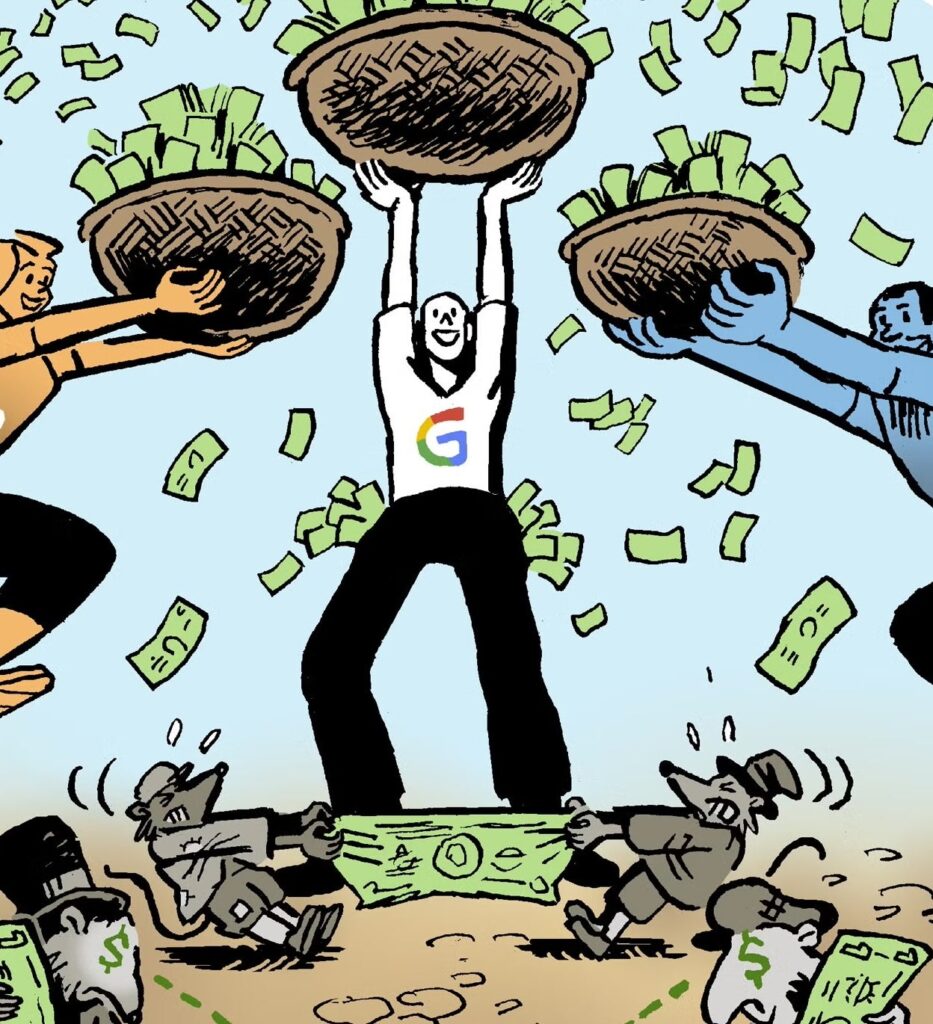

Far from first to market but number one in almost every other respect, Google now dominates Internet media. Unlike Amazon and eBay whose shares rose after their earnings announcement, Google shared Yahoo’s fate, seeing their stock price fall. With its shares having more than tripled since its IPO not too long ago, anything less than mind numbingly insane would not have appeased the investors. Qualifying as still mind numbing but perhaps not insane, Google saw earnings quadruple compared to the same period the year before. In 2004, the company earned just over $79 million in profit. This year, that number topped $342 million, which, to put into perspective, tops all other companies listed here. Revenues too soared, climbing more than $600 million to $1.38 billion – second only to e-tailer Amazon. Yet, investors expected more, and coupled with the announcement that third-quarter growth might not equal the already below expectation 10% growth Google saw from Q1 to Q2, their shares took a beating. Internet traffic in general slows down during the second quarter, and sustaining 15% to 28% quarter over quarter growth comes less easily, especially when earning more than a billion dollars quarterly.

Despite the net-net decrease in market capitalization after their collective earnings announcements, the fab-four profiled here had nothing short of fantastic results. Best of all, the results, like the companies themselves are real. While they conduct their business online, their results aren’t. Take for example the fact that more than 724,000 Americans report that eBay is their primary or secondary source of income, with another 1.5 million saying they supplement their income by selling on eBay. While Amazon doesn’t publish those figures, in its earnings statements it revealed that 28% of its revenues came from independent merchants. Without Google and Yahoo, tens of thousands of small businesses would not be online – both spending and receiving money. And let’s not forget eBay and Amazon’s prevalent spending on these two engines. True, three out of the four may have funny names, and those in the future may not, but these are the first generation of online to offline companies, and luckily, they won’t be the last.