Dollar General’s typical shopper resides in rural America, which can be a tough customer segment to target. The value retail chain sits down with Multichannel Marketer to discuss how its retail media network can tap into these shoppers.

Dollar General knows its customer best. And it knows that its customer base — rural shoppers — can be a tough group of shoppers for advertisers to target. And this is what makes its retail media network unique, said Charlene Charles, head of DG Media Network operations at Dollar General.

“Brands come to us because there is someone they can’t reach on their own, or they want to extend their reach,” Charles said.

Dollar General has more than 20,000 stores in 48 states. And 80% of those stores are in towns with a population of 20,000 people or fewer. Dollar General is often the closest option for them to shop for everyday essentials, such as groceries. That makes these shoppers more frequent shoppers to Dollar General and less accessible to advertisers that are going after larger audiences, Charles said.

“We’ve built loyalty programs and connectivity with our customers,” Charles said. “And whenever thinking about media, and optimizing for cost per visit, impressions, it can follow where the volume is: At urban areas,” Charles said.

In fact, Dollar General validated this with research it conducted with demand-side ad platform The Trade Desk. (Dollar General also uses The Trade Desk for brands to programmatically buy ad spots targeting its audience.)

“Almost 50% of our audiences weren’t available in third party demo segments,” Charles said about the research for normal categories consumers shop, such as toothpaste, snacks and baby products.

And that makes the Dollar General Retail Media Network appealing to the hundreds of brands that already advertise on it. On average, advertisers see about four to five times return on their ad spends, Charles said. “We feel great about that,” she said.

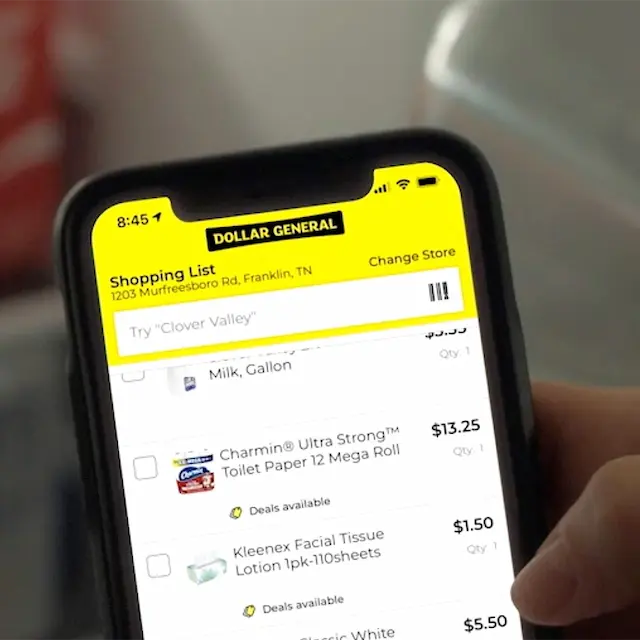

On its website and app, Dollar General offers sponsored product ads and homepage takeovers, as well as spots in its email and SMS marketing sends. In store, it recently launched ads on the radio. Off-site, Dollar General offers spots on mobile display, standard display, connected TV and audio, among others.

Retail Media Networks provide a measured way for brands to track their ad dollars

While in-store and audio advertising are popular choices right now for advertisers, most brands are looking to talk to shoppers across many channels for a full-funnel approach to advertising to lead to a conversion, Charles said.

“I would argue more that with the cookie crumbling and targeting moving from third party to first party data, when I spend a dollar, I want to know how effective it is. So a lot of budgets have shifted in the direction of retail media because it’s measured,” Charles said. “Everyone’s trying to have dollars work harder for them. And smarter. And putting those dollars in different places.”

Because of this marketing shift, many retailers have launched their own retail media networks as it is appealing to brands and provides an additional revenue stream for themselves.

Dollar General launched its retail media network in 2018 and used a third-party vendor for its technology. In 2022 it brought the technology in house and began marketing its value proposition to brands. It debuted this next iteration because “no one knows our customer better,” Charles said.

With many retailers building their own in-house technology to stand up these platforms (like Dollar General) advertisers have to learn the nuances of each platform in how to buy the spots and how they are measured. Lack of standardization across retail media platforms is a common complaint for brands. But until there is a standard way, retailers need to provide transparency to advertisers with transparency on how they are measuring their effectiveness, Charles said.

“You have to work with an advertiser on an individual level to decide how you want to define success, and how success and measurement come together. Full stop,” Charles said.